EUR/JPY price analysis: Pair holds bullish stance despite minor losses

- EUR/JPY trades near the 164.00 zone, maintaining a bullish stance despite minor losses.

- Momentum remains positive, supported by multiple moving averages.

- Key support rests around 163.60, with resistance near 164.90.

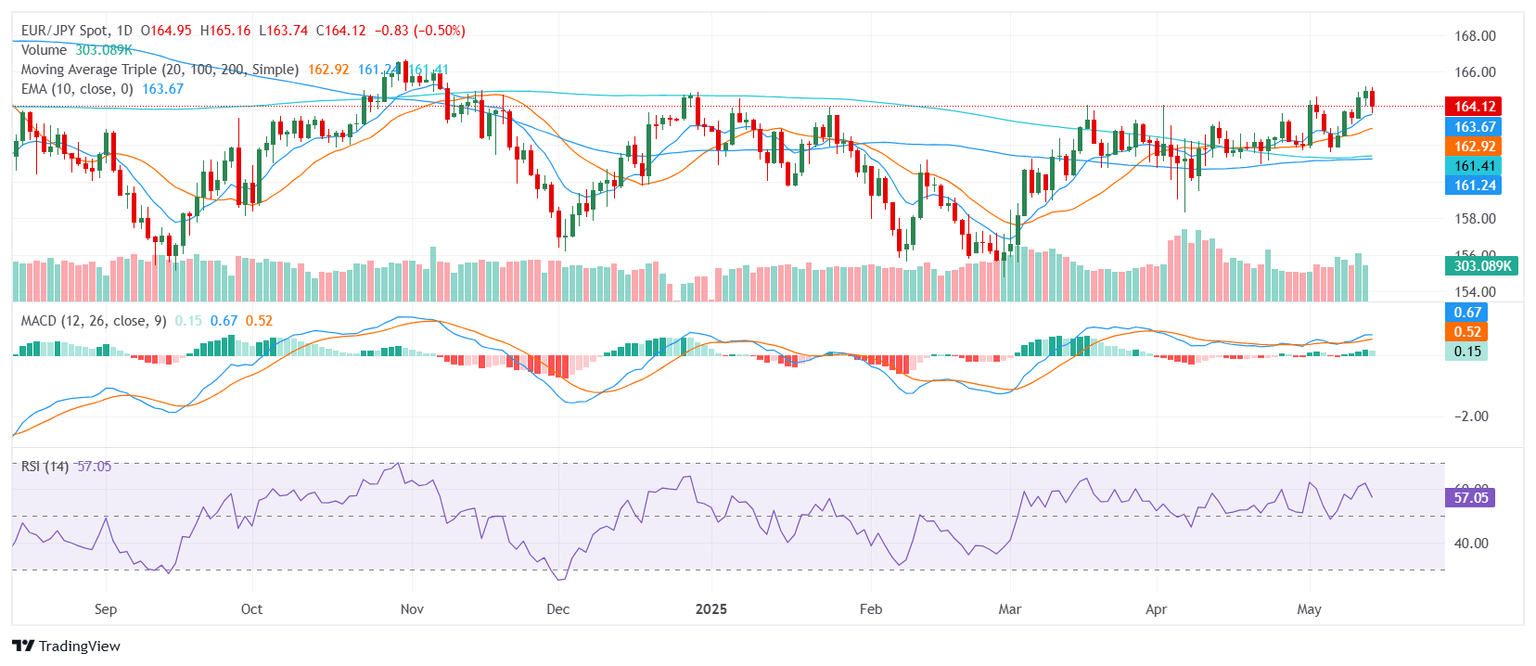

The EUR/JPY pair is trading near the 164.00 zone ahead of the Asian session on Wednesday, reflecting a slightly bullish tone despite minor losses on the day. The pair remains within the mid-range of its recent fluctuation, indicating a stable but cautious upward bias as traders assess broader market sentiment. Key technical indicators are signaling mixed but generally supportive momentum, aligning with the pair's broader bullish structure.

From a technical perspective, the Relative Strength Index (RSI) hovers in the 50s, reflecting neutral conditions, while the Moving Average Convergence Divergence (MACD) confirms ongoing buy momentum. Additional confirmation comes from the Williams Percent Range (14), Awesome Oscillator, and Bull Bear Power, all hovering around the 2 area, reinforcing the pair's balanced but upward bias.

Moving averages further support this outlook, with the 10-day Simple Moving Average (SMA) and 10-day Exponential Moving Average (EMA) both positioned in the 160s, aligning with the 20-day, 100-day, and 200-day SMAs, all signaling a broader buy trend. This multi-timeframe alignment indicates a solid underlying bullish structure, despite recent minor losses.

Immediate support is identified around 163.66, followed by deeper levels at 163.61 and 163.11. On the upside, resistance is expected near 164.93, potentially capping gains in the near term.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.