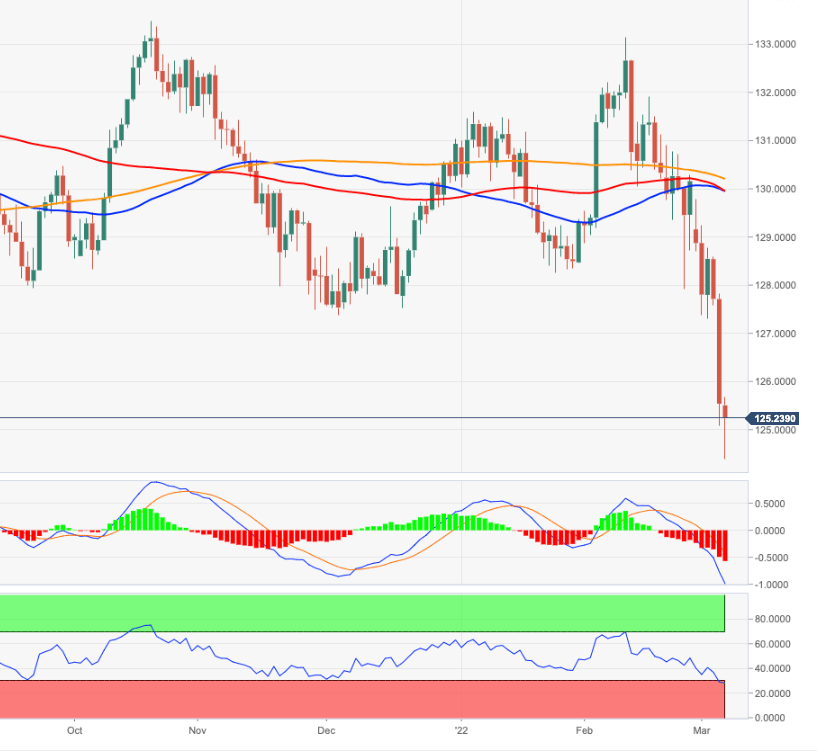

EUR/JPY Price Analysis: Outlook remains largely on the negative side

- EUR/JPY collapses to the 124.40 region on Monday.

- The next target comes at the 122.80 zone (November 2020).

The leg lower in EUR/JPY gathers extra steam and revisits the 124.40 zone at the beginning of the week.

The breakdown of the 125.00 yardstick has opened the door to further retracements in the near term, with minor contention seen at 122.84 (November 19 low). If cleared, then the cross is expected to meet the next support of note at the October 2020 low at 121.61 (October 30).

While below the 200-day SMA, today at 130.16, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.