EUR/JPY Price Analysis: Next on the upside now comes 146.70

- EUR/JPY extends the move higher and prints new 2023 highs.

- The December 2022 peak near 146.70 now emerges on the horizon.

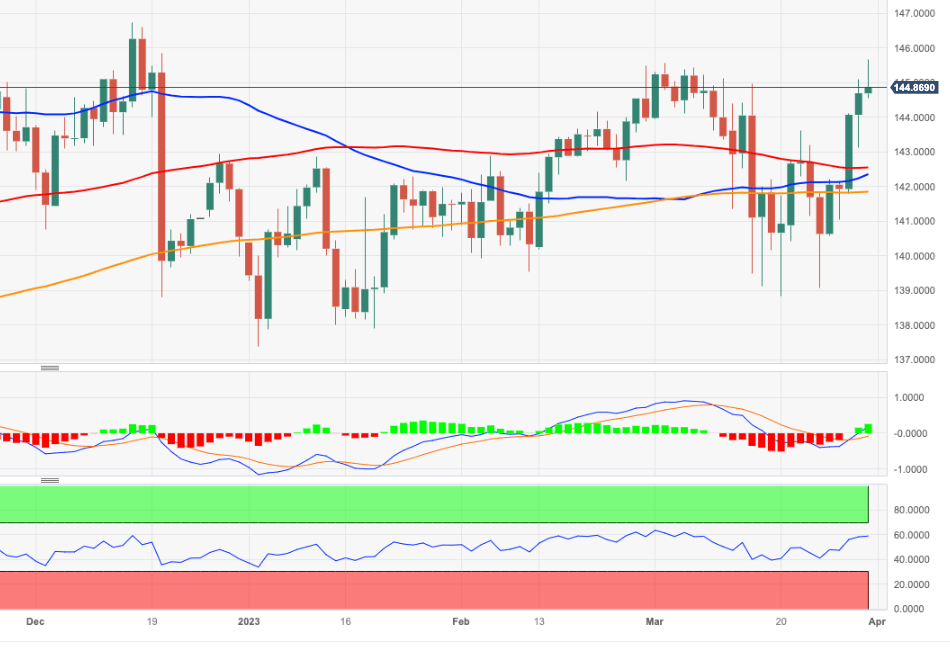

EUR/JPY advances past the 145.00 hurdle to record new YTD peaks in the 145.65/70 band on Friday.

A daily close above the 2023 peak should motivate the cross to shift its focus to the December 2022 top around 146.70 (December 15) in the short-term horizon.

In the meantime, extra gains remain on the table while the cross trades above the 200-day SMA, today at 141.81.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.