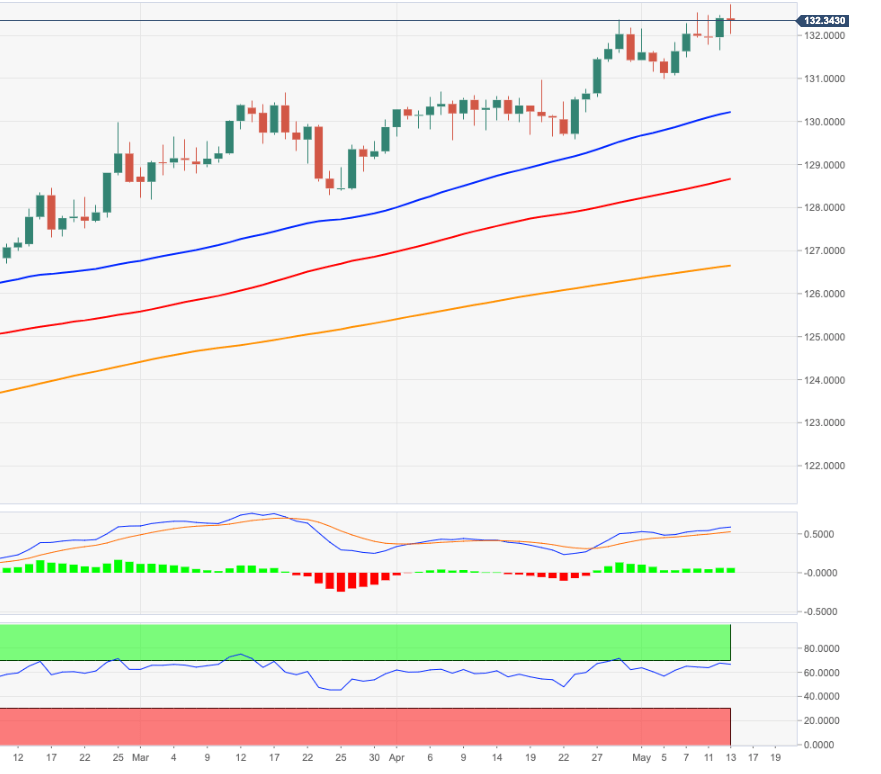

EUR/JPY Price Analysis: Next on the upside comes in 133.00

- EUR/JPY clinches fresh YTD peaks beyond 132.70.

- The next target of note now comes in at the 133.00 mark.

EUR/JPY adds to the recent uptick and records new 2021 peaks in the 132.70/75 band on Thursday.

If the buying impulse gathers extra pace the cross could attempt a move to the 133.00 neighbourhood ahead of the September 2018 high at 133.13. Further gains remain likely while above the immediate support line (off the March lows) near 130.30. This area is also reinforced by the 50-day SMA.

In the broader picture, while above the 200-day SMA at 126.61 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.