EUR/JPY Price Analysis: Next on the upside comes 156.80

- EUR/JPY accelerates its upside and records new 2023 peaks.

- The next up-barrier is expected not before the 156.80 region.

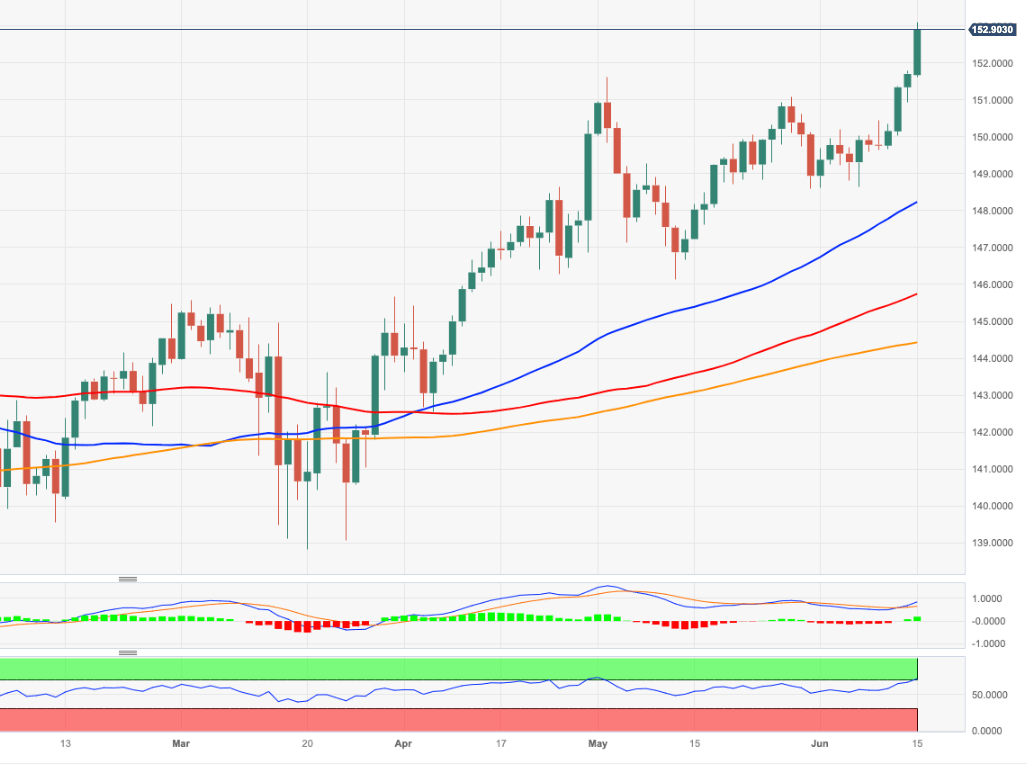

EUR/JPY climbs markedly to new 2023 peaks just above the 153.00 hurdle on Thursday.

The current scenario remains open to extra gains in the short-term horizon. Against that, there are no resistance levels of note until the weekly low recorded in late September 2008 at 156.83, which precedes the key round level at 157.00.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 144.39.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.