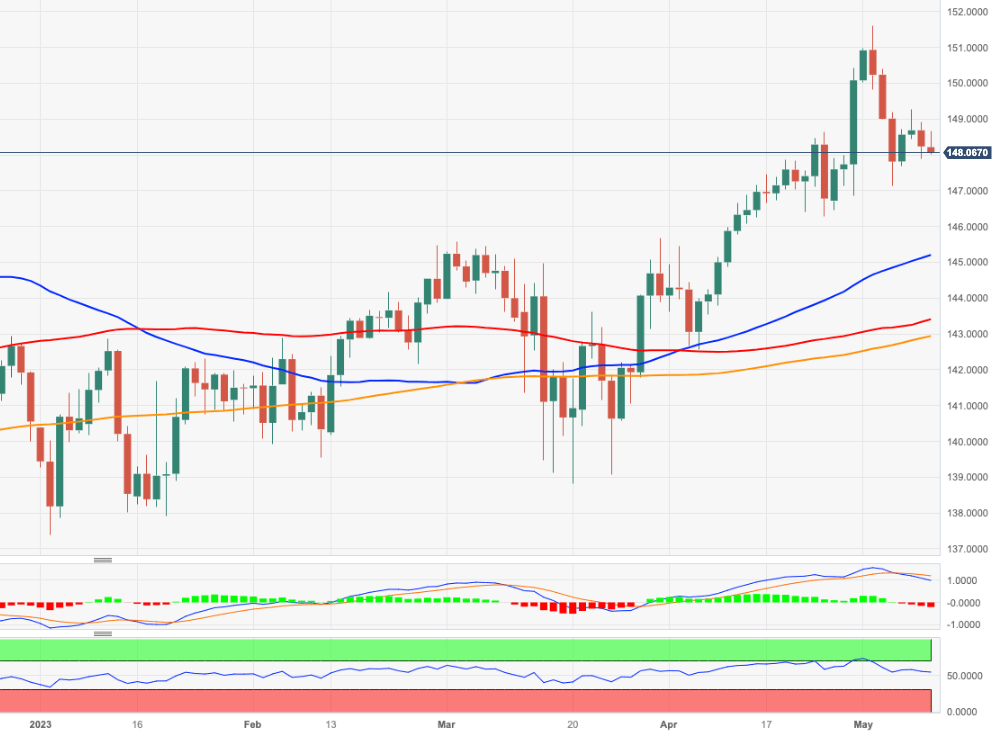

EUR/JPY Price Analysis: Next decent contention is seen at 146.30

- EUR/JPY faces extra selling pressure and flirts with 148.00.

- Further decline could put the 146.30 region to the test in the near term

EUR/JPY adds to Tuesday’s bearish performance and puts 148.00 to the test on Wednesday.

It seems the bullish outlook now appears somewhat dented. Against that, the cross could initially revisit the weekly low at 147.12 (May 4), while the loss of this level could spark a deeper decline to the weekly low at 146.28 (April 25).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.90.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.