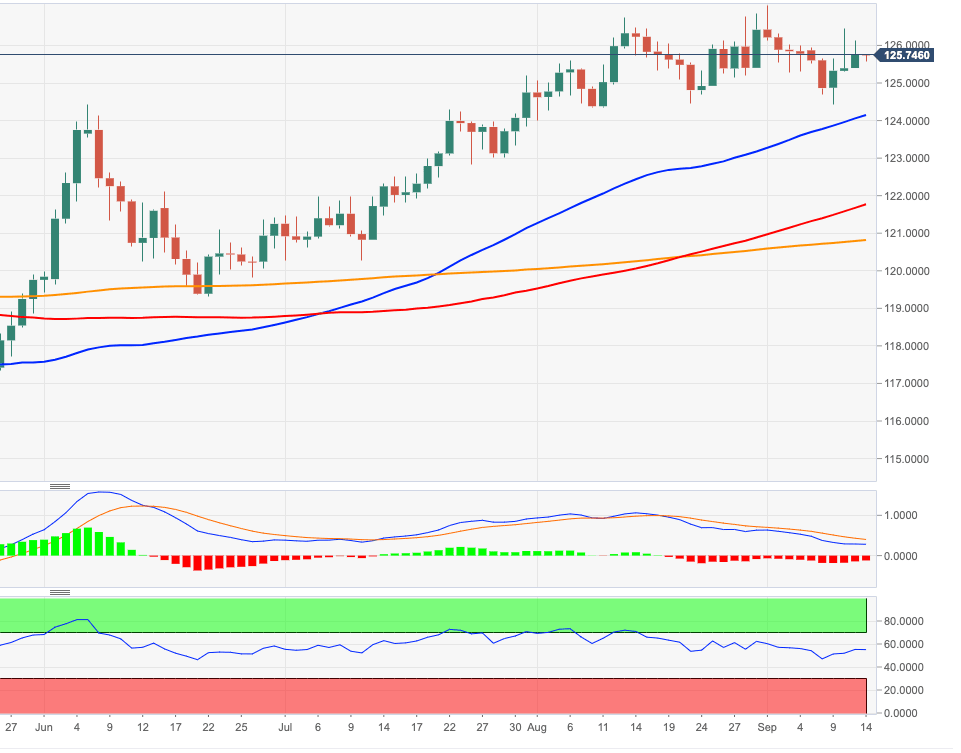

EUR/JPY Price Analysis: Interim hurdle emerges at 126.46

- EUR/JPY trades within a narrow range in the 125.70 region on Monday.

- There is an interim resistance at the post-ECB high near 1256.50.

EUR/JPY is alternating gains with losses below the 126.00 mark at the beginning of the week.

Bulls need to surpass last week’s top near 126.50 (post-ECB meeting highs) to allow for another attempt to visit the 2020 highs just beyond 127.00 the figure recorded on September 1.

The constructive view around EUR/JPY is predicted to remain unchanged while above the 200-day SMA at 120.77.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.