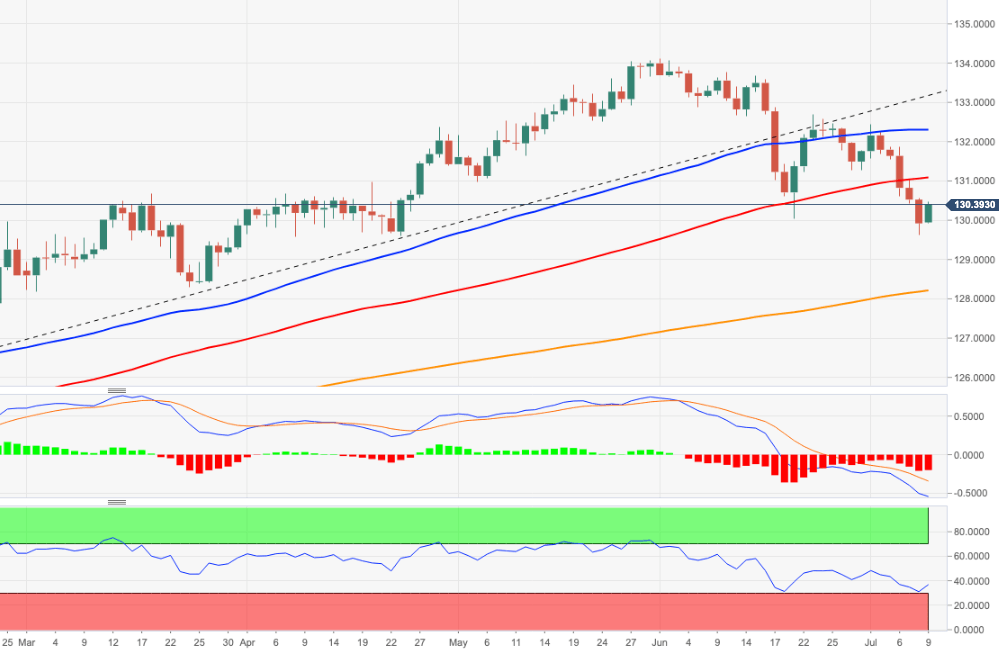

EUR/JPY Price Analysis: Initial contention emerges near 129.50

- EUR/JPY rebounds from lows in the mid-129.00s.

- Downside pressure alleviated above 132.70.

The downside momentum in EUR/JPY seems to have met initial contention in the 129.50 region on Thursday. This support area coincides with the April lows.

The continuation of the recovery targets some minor hurdles at the 100-day SMA just above 131.00, the 20-day SMA near 131.70 and the so far July peaks around 132.40 (July 1).

Furthermore, the ongoing bearish stance is expected to mitigate beyond weekly highs around 132.70 (June 23).

In the meantime, the outlook for the cross is seen as constructive while it trades above the 200-day SMA, today at 128.15.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.