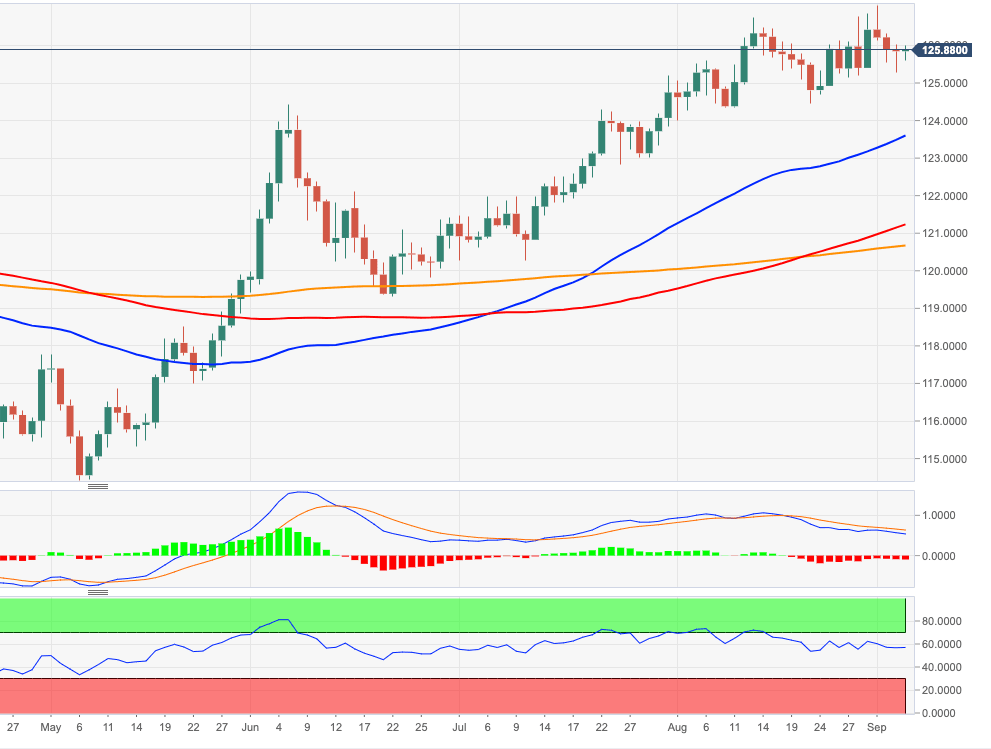

EUR/JPY Price Analysis: Initial contention emerges around 125.30

- EUR/JPY stays flat just below the 126.00 yardstick on Friday.

- The consolidative mood is expected to persist ahead of US NFP.

EUR/JPY’s corrective downside met support near 125.30 on Thursday, regaining some composure since then and now navigating within a narrow range, all in line with the rest of the global assets.

The current downside should be deemed as corrective only and carries the potential to extend to the 124.40 zone (low August 21) ahead of the probable resumption of the bullish trend.

The constructive view around EUR/JPY is predicted to remain unchanged while above the 200-day SMA at 120.63.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.