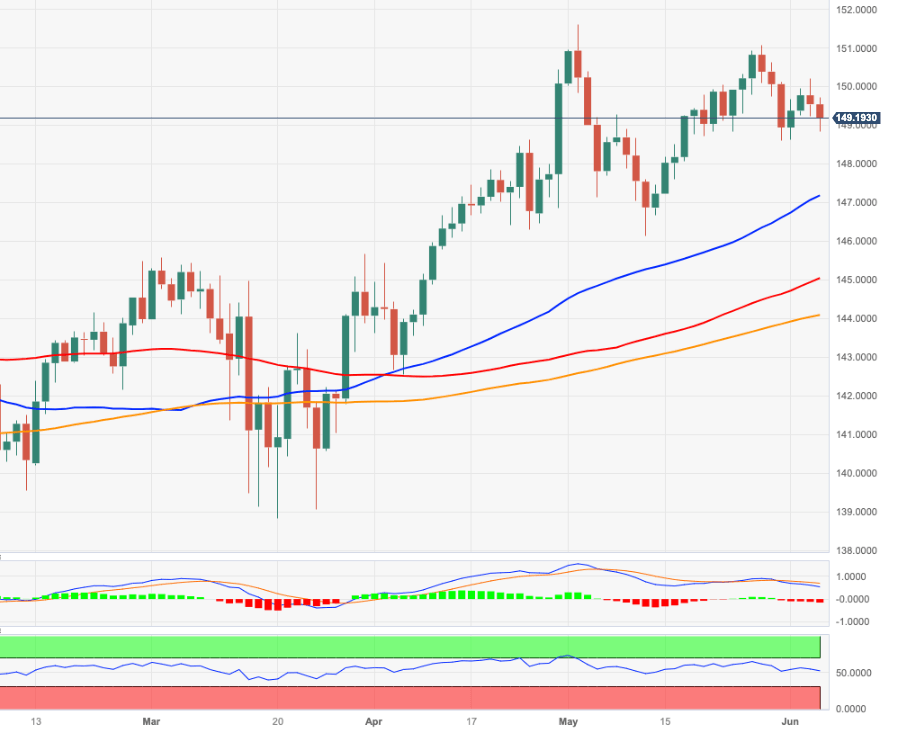

EUR/JPY Price Analysis: Gains remain limited around 151.00

- EUR/JPY adds to Monday’s pullback and breaches 149.00.

- Occasional bullish attempts should meet a tough barrier near 151.00.

EUR/JPY corrects further south and retreats to the sub-149.00 region on Tuesday.

In case bulls regain the initiative, there is an immediate hurdle at the so far monthly high at 150.19 (June 5). The convincing surpass of this level could put the weekly top at 151.07 (May 29) back on the radar prior to the 2023 peak at 151.61 (May 2).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 144.05.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.