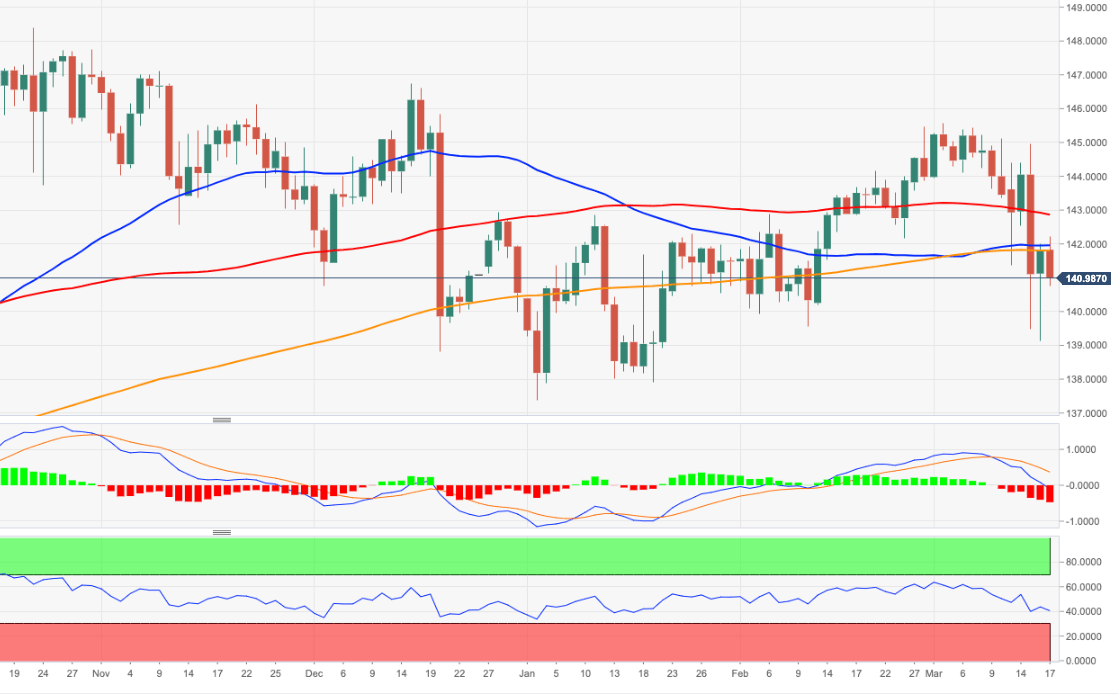

EUR/JPY Price Analysis: Further losses likely below the 200-day SMA

- EUR/JPY comes under pressure and fades Thursday’s advance.

- Extra weakness remains on the cards below the 200-day SMA.

EUR/JPY resumes the downside and returns to the sub-141.00 region at the end of the week.

The cross looks side-lined in the second half of the week in the lower end of the weekly range. Occasional bullish attempts should initially clear the provisional 100-day SMA near 142.80 to allow for a test of the 2023 high at 145.56 (March 2).

In the meantime, extra losses remain on the cards while the cross trades below the 200-day SMA. If losses accelerate, then a potential visit to the March low at 139.11 (March 16) should start emerging on the horizon.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.