EUR/JPY Price Analysis: Further gains target the 2023 high

- EUR/JPY adds to Thursday’s gains and approaches 159.00.

- Extra gains look likely in the short-term horizon.

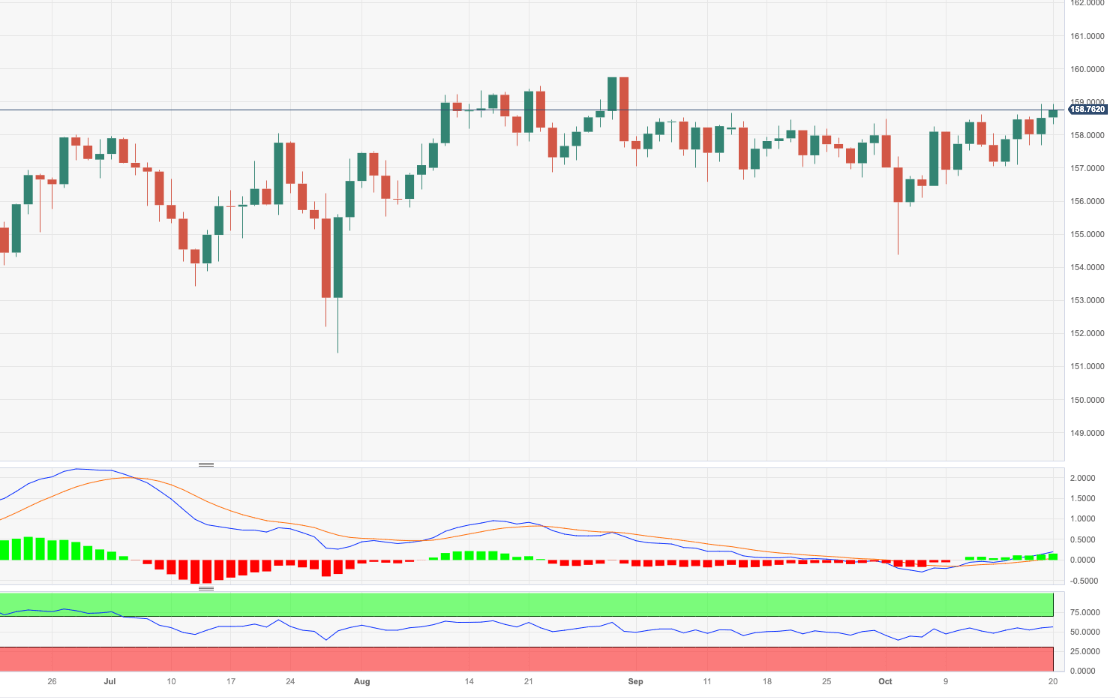

EUR/JPY advances further and prints new multi-week tops near the 159.00 barrier at the end of the week.

Considering the ongoing price action, the cross could now challenge the 2023 peak at 159.76 (August 30) in the near term, just ahead of the round level of 160.00.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 150.69.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.