EUR/JPY Price Analysis: Further consolidation likely near-term

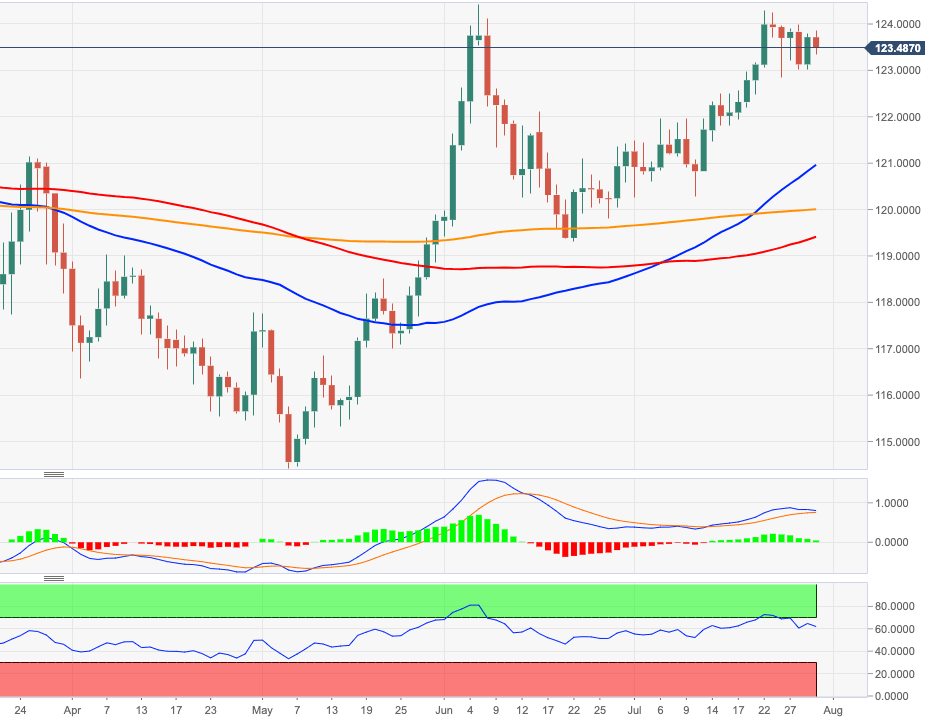

- EUR/JPY is prolonging the rangebound theme above 123.00.

- The key support area around 122.90 holds the downside so far.

EUR/JPY now seems to have entered into a consolidative phase around the mid-123.00s in the unchanged context of firm JPY-buying and despite the constructive view on the single currency.

Extra upside momentum remains well on the cards in spite of the ongoing consolidation and is expected to target the 2020 peaks beyond the 124.00 mark in the short-term horizon. If sellers regain the upper hand, then the leg lower could test the short-term support line, today around 121.30.

As long as EURJPY trades above the 200-day SMA at 119.97, the positive outlook is expected to remain unchanged.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.