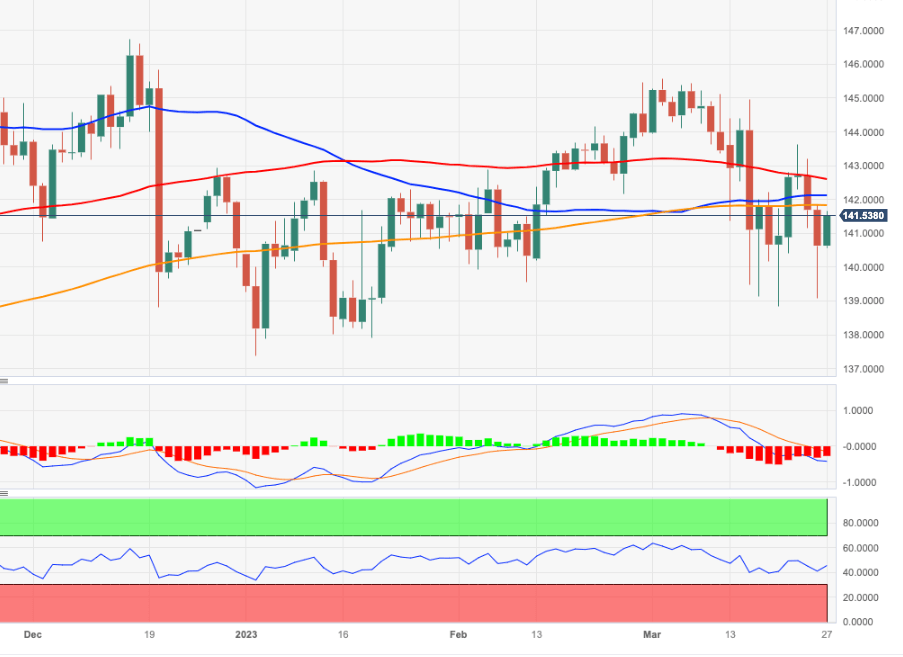

EUR/JPY Price Analysis: Further consolidation in store so far

- EUR/JPY leaves behind three consecutive daily pullbacks on Monday.

- Extra range bound trade should remain on the cards for the time being.

EUR/JPY bounces off Friday’s weekly lows and retakes the 141.00 barrier and above at the beginning of the week.

The cross now flirts with the key 200-day SMA near 141.80, and a sustainable surpass of this region should open the door to further upside in the short-term horizon. Moving forward, the consolidation theme is expected to remain unchanged as long as the March peaks around 145.50 continue to cap the upside.

In the meantime, extra losses remain in store while the cross trades below the 200-day SMA.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.