EUR/JPY Price Analysis: Flatlines around 158.00 as a doji emerges

- EUR/JPY sees minimal gains in a risk-off environment, influenced by contrasting US economic reports and JPY dynamics.

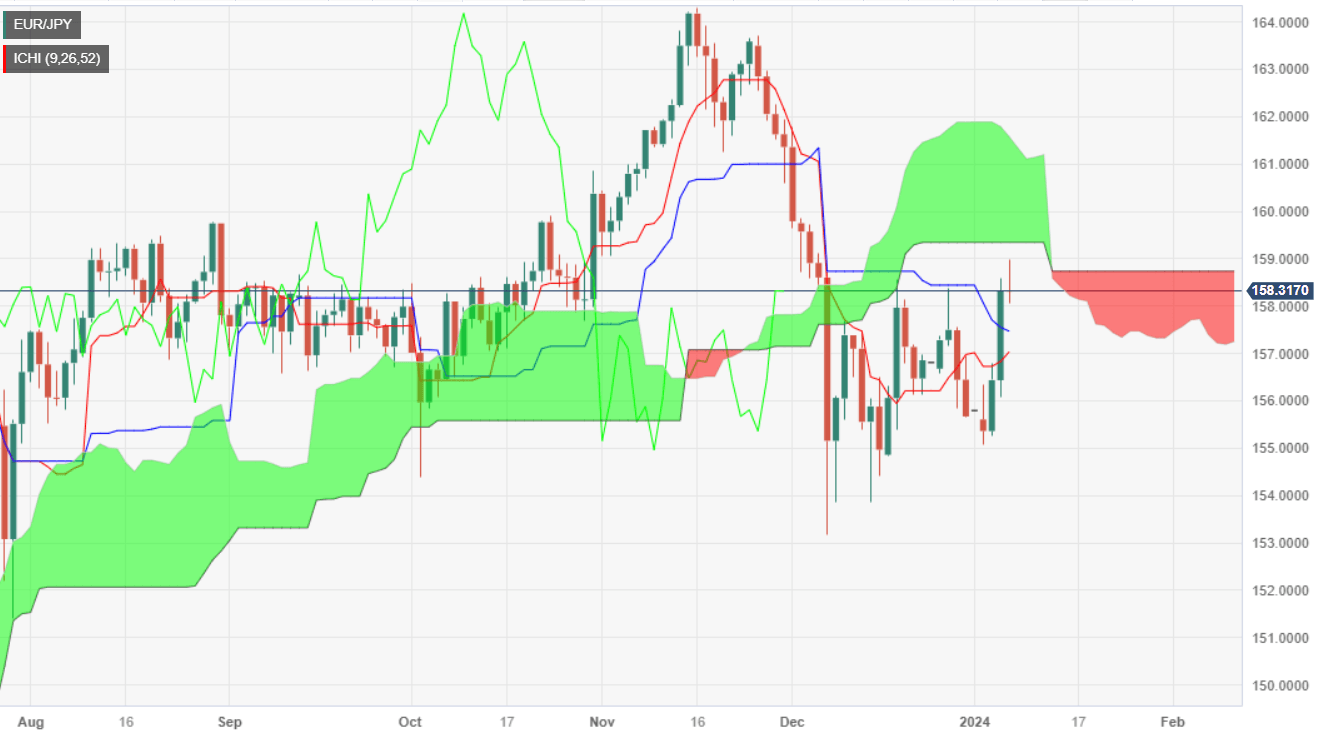

- Potential downward pressure could lead to tests of Kijun-Sen at 157.52 and Senkou Span B, with further support at 157.03.

- For upward momentum, buyers need to break above 159.00, targeting Ichimoku Cloud bottom at 159.32 and 160.00 resistance.

The EUR/JPY clings to minuscule gains of 0.01% late in Friday trading, courtesy of a risk-off impulse amid mixed economic data from the United States (US). Consequently, the Japanese Yen (JPY) gained some ground against the US Dollar (USD), as seen by the USD/JPY, trimming some of its losses, which underpinned the cross-pair. At the time of writing, the pair is trading at 158.33 after seesawing within the 158.07/99 range.

During the last three days, the EUR/JPY has managed to rise above the 158.00 figure, but failure to reclaim 159.00 leaves the pair exposed to selling pressure. If sellers step in, they could drive prices toward the Kijun-Sen at 157.52, ahead of testing the Senkou Span B at 157.52. A breach of the latter will expose the Senkou Span A, followed by the Tenkan-Sen at 157.03.

If buyers emerge at current levels, they must regain 159.00 so they can test the bottom of the Ichimoku Cloud (Kumo) at 159.32. The next supply zone would be the 160.00 handle, followed by the top of the Kumo at around 161.35/55.

EUR/JPY Price Action - Daily Chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.