EUR/JPY Price Analysis: Extra losses likely near-term

- EUR/JPY looks offered and challenges 133.00.

- The 132.50 area should offer decent contention.

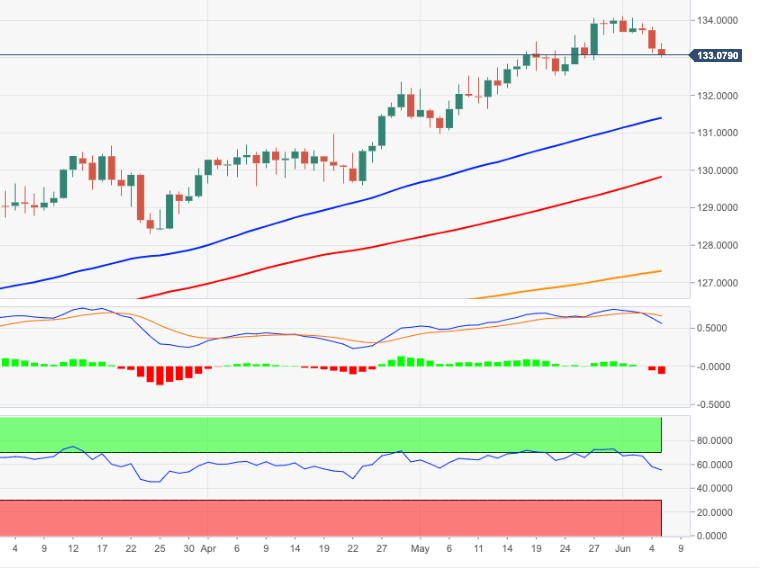

EUR/JPY drops to new multi-day lows in the vicinity of the 133.00 neighbourhood at the beginning of the week.

If the selling pressure gathers extra steam, then the cross could attempt a deeper pullback to, initially, the weekly lows near 132.50 (May 24). Further south comes in the 131.60/50 region, where coincides the 50-day SMA and the short-term support line.

In the broader picture, while above the 200-day SMA at 127.27 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.