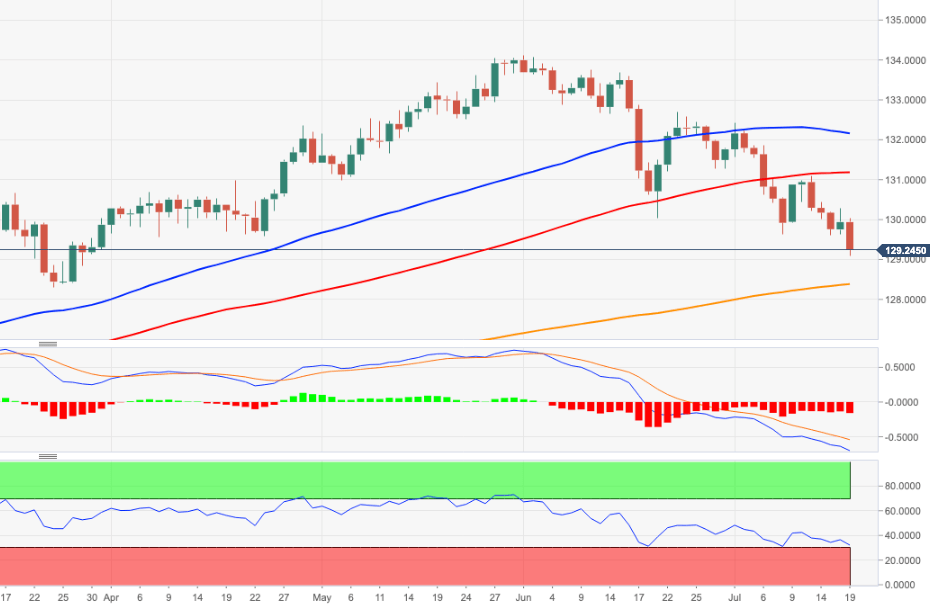

EUR/JPY Price Analysis: Extra downside exposes the 200-day SMA

- EUR/JPY resumes the downside well below 130.00.

- Further south comes in the 200-day SMA at 128.33.

The leg lower in EUR/JPY picks up renewed pace and challenges the support at the 129.00 neighbourhood at the beginning of the week.

The loss of this area should expose further downside. That said, there is a minor support at 128.54 (Fibo level) ahead of the critical 200-day SMA, today at 128.33.

Above the latter, the broader outlook for the cross is seen as constructive for the time being.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.