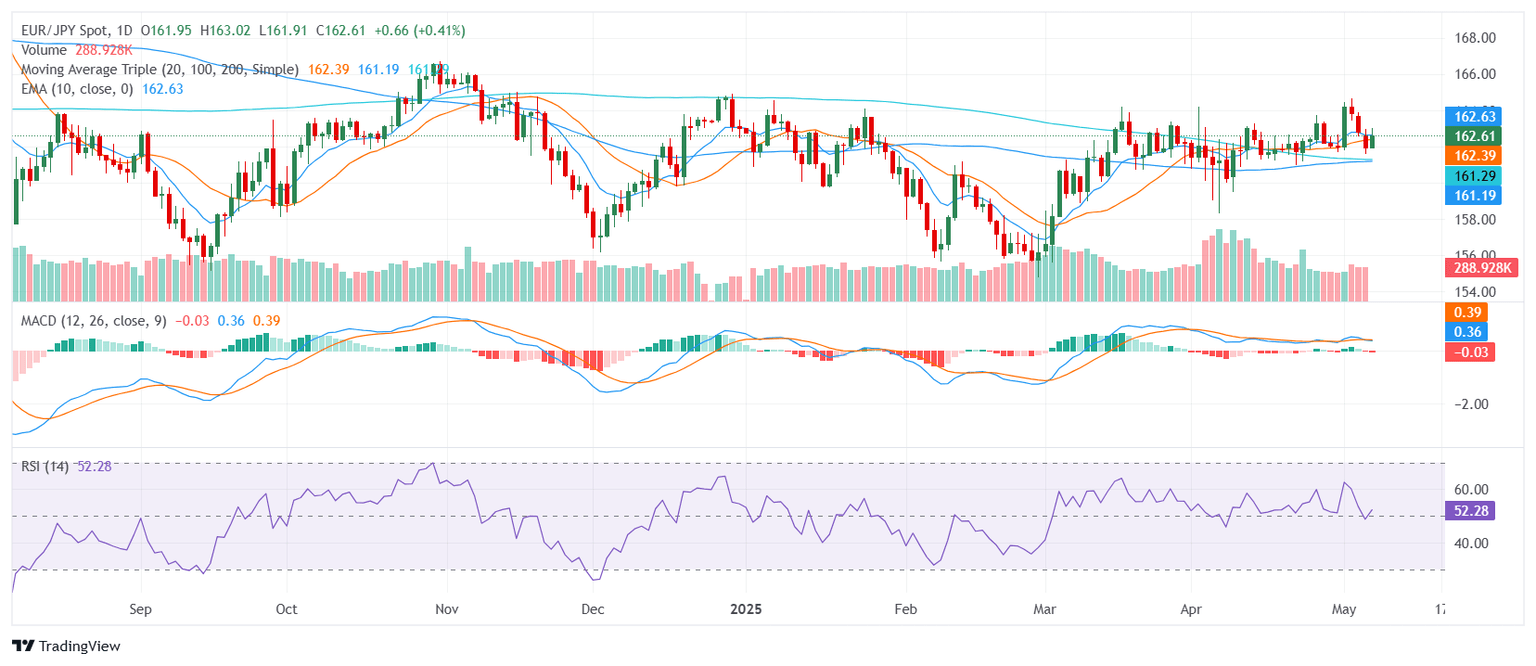

EUR/JPY Price Analysis: Euro holds steady near 163.00 as bullish signals build

- EUR/JPY trades around the 163.00 zone after a modest advance in Wednesday’s session.

- Broader bias remains bullish, supported by rising moving averages despite mixed momentum.

- Key support holds just below, while resistance is clustered near recent highs.

The EUR/JPY pair edged higher on Wednesday, trading around the 163.00 zone, reflecting a steady upward bias as the market heads into the Asian session. Despite mixed momentum signals, the broader technical outlook remains constructive, with the pair supported by a series of rising moving averages that reinforce the underlying bullish structure.

Technically, the EUR/JPY is flashing a bullish overall signal. The Relative Strength Index remains neutral near 52, indicating balanced momentum without immediate overbought or oversold conditions. The Moving Average Convergence Divergence, however, suggests a slight loss of momentum with a sell signal, while the Ultimate Oscillator and Williams Percent Range are also neutral, pointing to a temporary stalling in buying pressure.

The backbone of the bullish case lies in the alignment of key trend indicators. The 20-day, 100-day, and 200-day Simple Moving Averages are all positioned below the current price and maintain upward slopes, providing strong structural support. Similarly, the 30-day Exponential and Simple Moving Averages are trending higher, reinforcing the broader uptrend.

Support is found at 162.38, 162.37, and 162.34. Resistance is seen at 162.60, 162.64, and 162.71. A break above these levels could trigger further bullish momentum, while failure to hold support may lead to a short-term correction without significantly altering the broader trend.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.