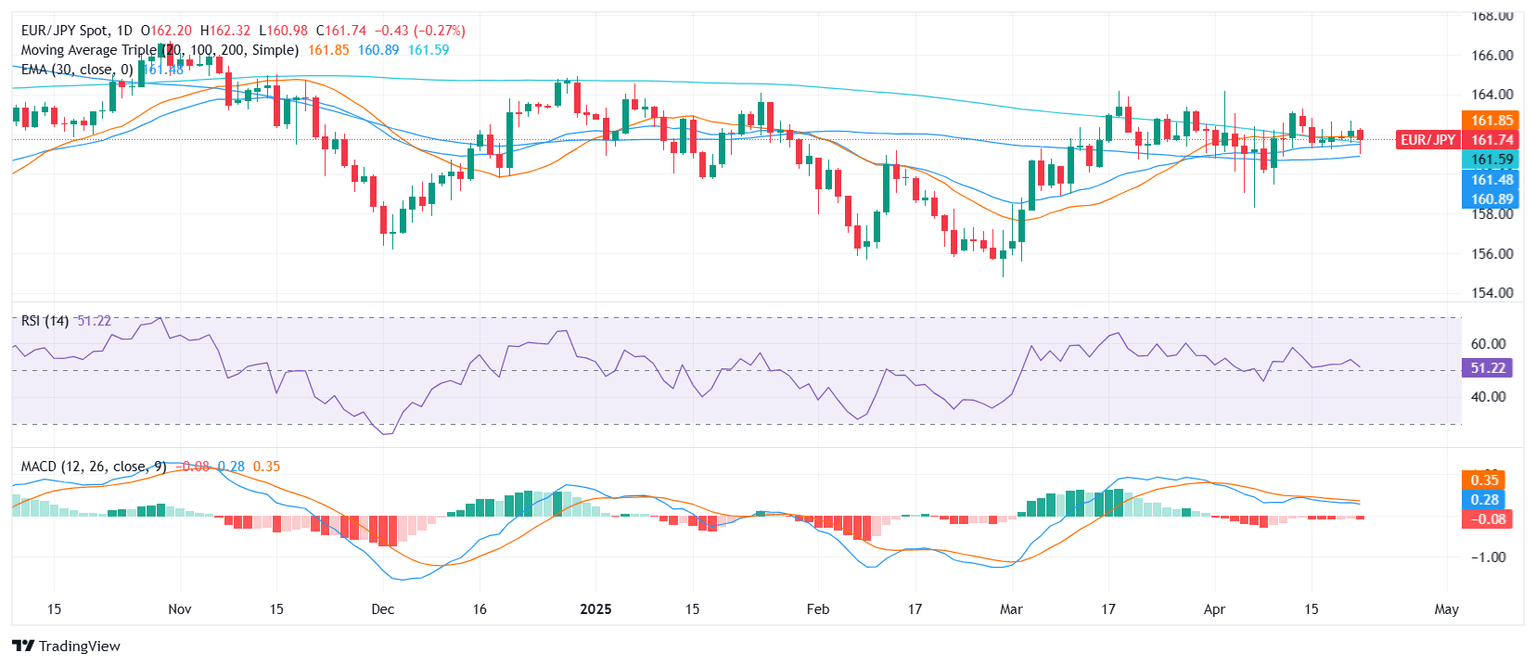

EUR/JPY Price Analysis: Drifts near 162.00 as technical picture turns indecisive

- EUR/JPY trades near the 162.00 zone, slightly lower ahead of the Asian session.

- Mixed signals from indicators, with MACD flashing a sell and most others remaining neutral.

- Support seen at 161.72, 161.71, and 161.66, while resistance stands at 161.79, 161.86, and 161.87.

The EURJPY pair is currently neutral, trading near the 162.00 zone after easing slightly on Tuesday. The pair remains confined within a narrow range between 160.98 and 162.32, showing no clear directional bias as Asian markets approach.

Momentum indicators reflect the indecision in price action. The Relative Strength Index holds steady in neutral territory near 51, while the MACD suggests a slight bearish tilt. Other short-term signals, such as the Stochastic RSI Fast and the Average Directional Index, are also neutral, further reinforcing the lack of strong trend conviction.

On the moving averages front, the 20-day SMA points to a short-term bearish trend, while the 100-day and 200-day SMAs suggest a longer-term bullish outlook. The Ichimoku Base Line remains neutral, in line with the broader sideways structure seen in recent sessions.

Key support levels are located at 161.72, 161.71, and 161.66, while resistance lies overhead at 161.79, 161.86, and 161.87. The pair will likely require a decisive break beyond this range to establish clearer momentum in either direction.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.