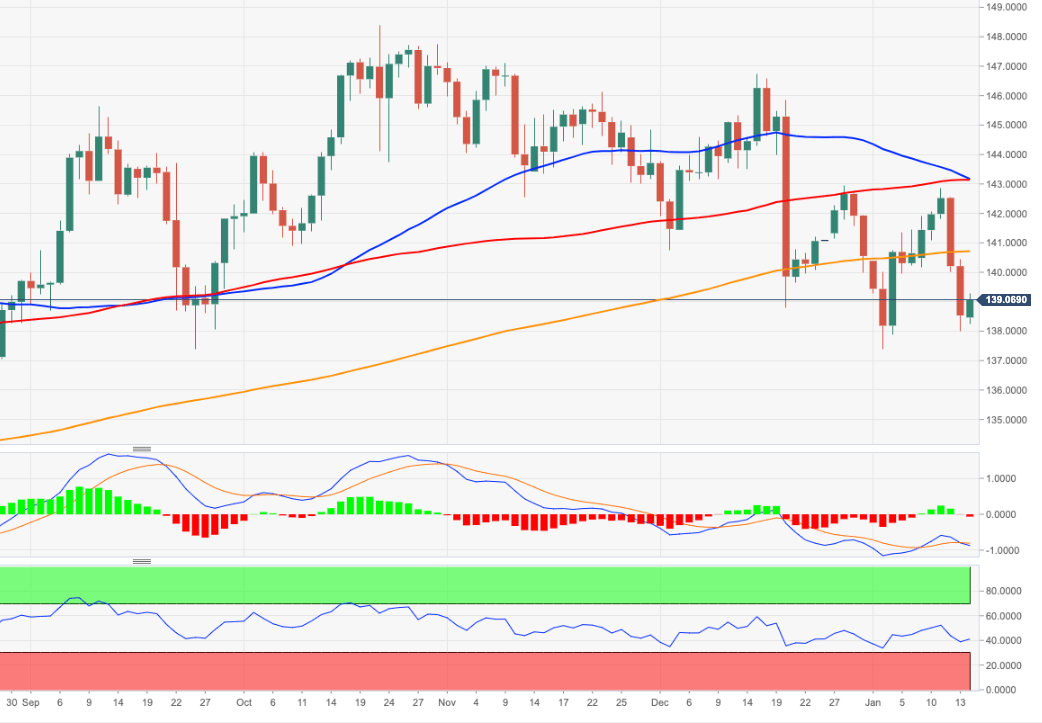

EUR/JPY Price Analysis: Downside pressure alleviated above the 200-day SMA

- EUR/JPY manages to grab some upside traction above 139.00.

- Next on the upside for the cross appears the 200-day SMA.

EUR/JPY gathers some much needed steam and reclaims the 139.00 hurdle and beyond at the beginning of the week.

The recent pronounced correction in the cross seems to have met some contention around the 138.00 neighbourhood. If the rebound picks up a more sustainable pace, then the next target of note turns up at the key 200-day SMA, today at 140.68.

Above the latter, the selling bias is expected to mitigate and could shift the outlook to a more constructive one.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.