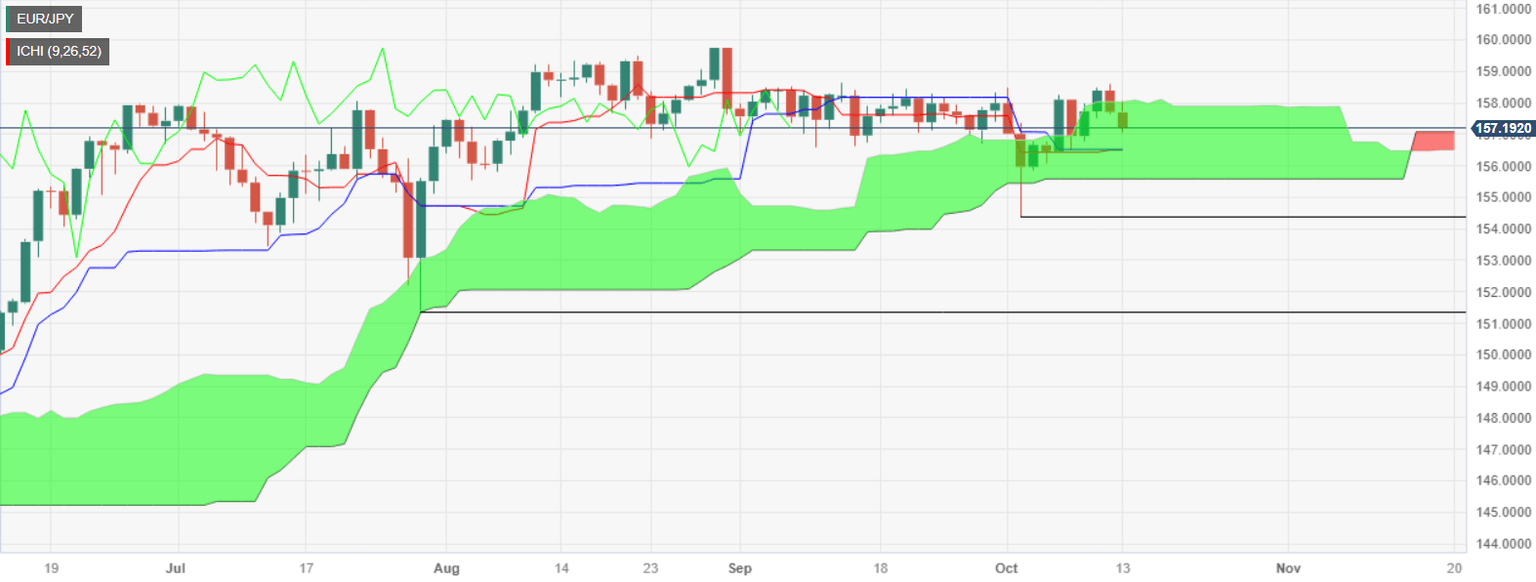

EUR/JPY Price Analysis: Dips inside the Kumo, as bears loom around 157.00

- EUR/JPY slips inside the Ichimoku Cloud after maintaining levels above it for the past three sessions.

- The pair breaches the October 12 low of 157.64, with potential further descent towards crucial support levels identified around 156.49/47, 156.00 mark, and Kumo’s bottom at 155.55/60.

- For upward momentum, the EUR/JPY needs to reclaim the 158.00 level to challenge the top of the Kumo at 158.05/10.

EUR/JPY finally dropped inside the Ichimoku Cloud (Kumo) after flirting during the last three trading days, with the cross-currency pair printing back-to-back days of losses. As we head into the weekend, the pair trades at 157.08, down 0.35%.

The daily chart shows the EUR/JPY drifting lower, below the October 12 low of 157.64, extending its losses toward the figure. A breach of the latter and the cross would drop to the confluence of the Kijun and Tenkan-Sen levels at around 156.49/47, followed by the 156.00 psychological level. If those demand areas are taken, the bottom of the Kumo at 155.55/60, emerges as the last line of defense for bulls before the pair turns bearish.

On the flip side, if EUR/JPY buyers step in, they must claim the 158.00 mark, before cracking the top of the Kumo at 158.05/10. Once cleared, the next resistance would be the October 12 swing high at 158.61, before climbing toward 159.00.

EUR/JPY Price Action – Daily chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.