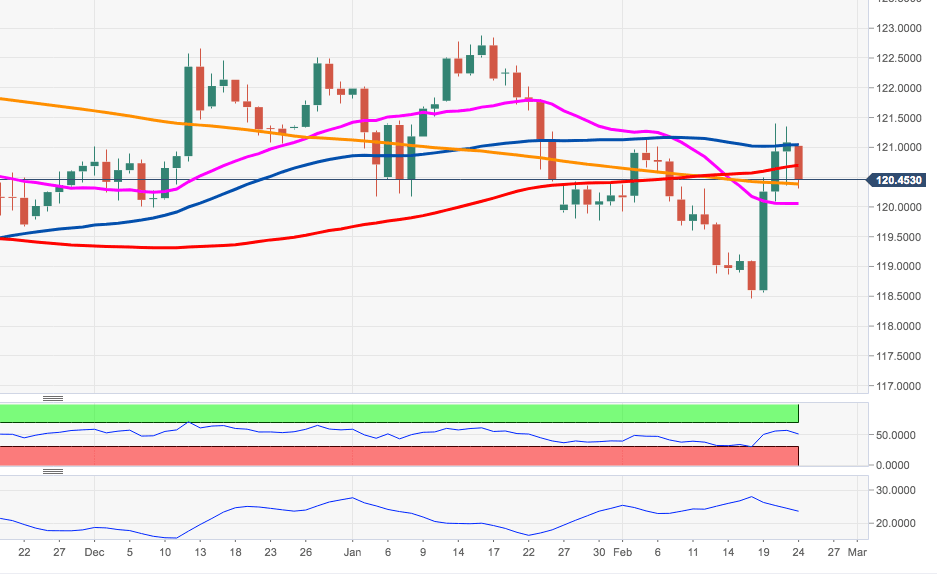

EUR/JPY Price Analysis: Decline is challenging the 200-day SMA

- EUR/JPY eroded past gains and is now flirting with the 200-day SMA.

- Interim support emerges at the 21-day SMA just above 120.00.

Following three consecutive sessions with gains, EUR/JPY has now come under selling pressure and is testing the 120.40 region, where sits the critical 200-day SMA.

If sellers intensify their will, then the 21-day SMA in the 120.00 neighbourhood should come into focus.

Further south, there are no relevant contention until yearly lows in the 118.50 zone.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.