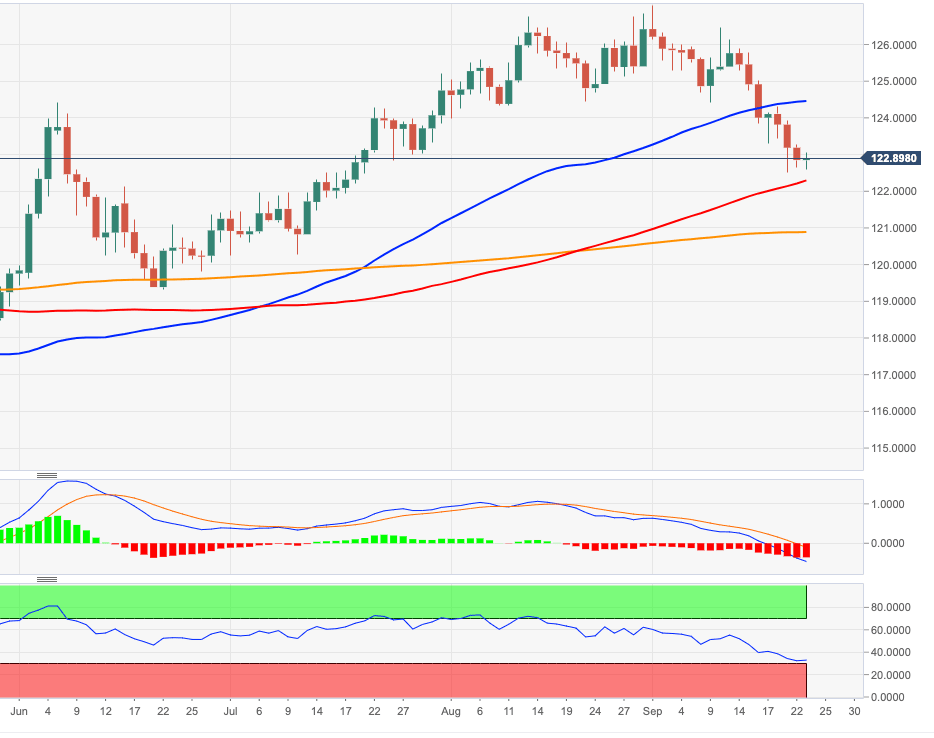

EUR/JPY Price Analysis: Decent support emerges around 122.50

- EUR/JPY seems to have met solid contention in the mid-122.00s.

- Further south comes in the 100-day SMA at 122.27.

EUR/JPY regains some composure after bottoming out in the 122.50 region so far this week, the lowest level since mid-July.

The bearish note seems still in place and a move to the minor support at the 100-day SMA at 122.27 should not be discarded just yet. If cleared, then the critical 200-day SMA, today at 120.86, should return to the investors’ radar.

Below the 200-day SMA the outlook on the cross is expected to shift to bearish.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.