EUR/JPY Price Analysis: Bulls maintain control, bears are not done yet and appear to gear up

- Daily indicators are pulling back, but remain reem in positive zone.

- For the short-term, the hourly chart indicators reveal a continued bullish bias, with a possibility of minor retractions.

- Fundamentals favored the bears on Monday, and the Yen was one of the best-performing currencies.

The EUR/JPY pair stands at 168.11 under strong bull control, reflecting a steady uptrend with a 0.38% gain on Tuesday. Despite Monday’s sharp losses, the buyers are still in command with indicators near overbought territory on the daily chart, but bears are around the corner waiting their time.

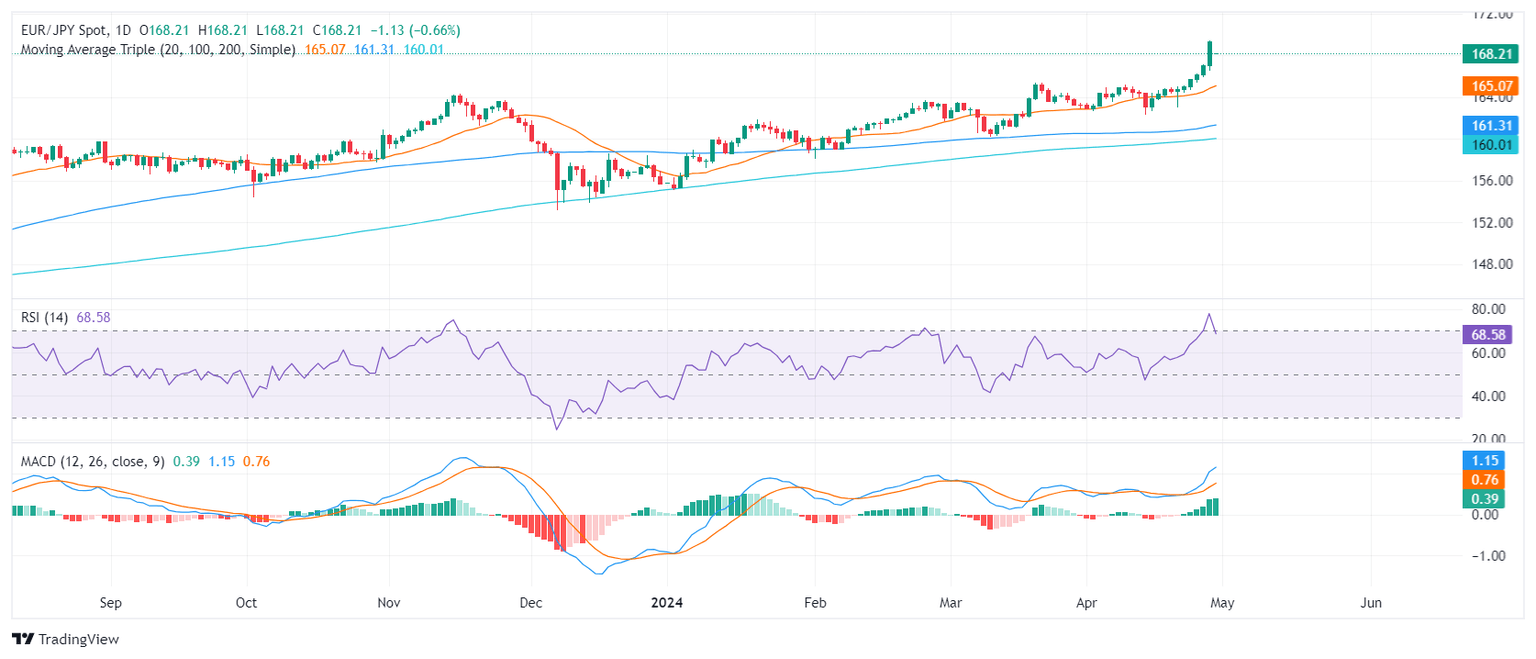

On the daily chart, the Relative Strength Index (RSI) lies just below 70 while the Moving Average Convergence Divergence (MACD) histogram maintains a stable green outlook, signifying a stable positive momentum. Most recently, the RSI is deep in the positive territory, and along with a flat green MACD, indicates that buyers currently dominate the market; however, a near overbought signal suggests potential further consolidation or pullback in the next sessions.

EUR/JPY daily chart

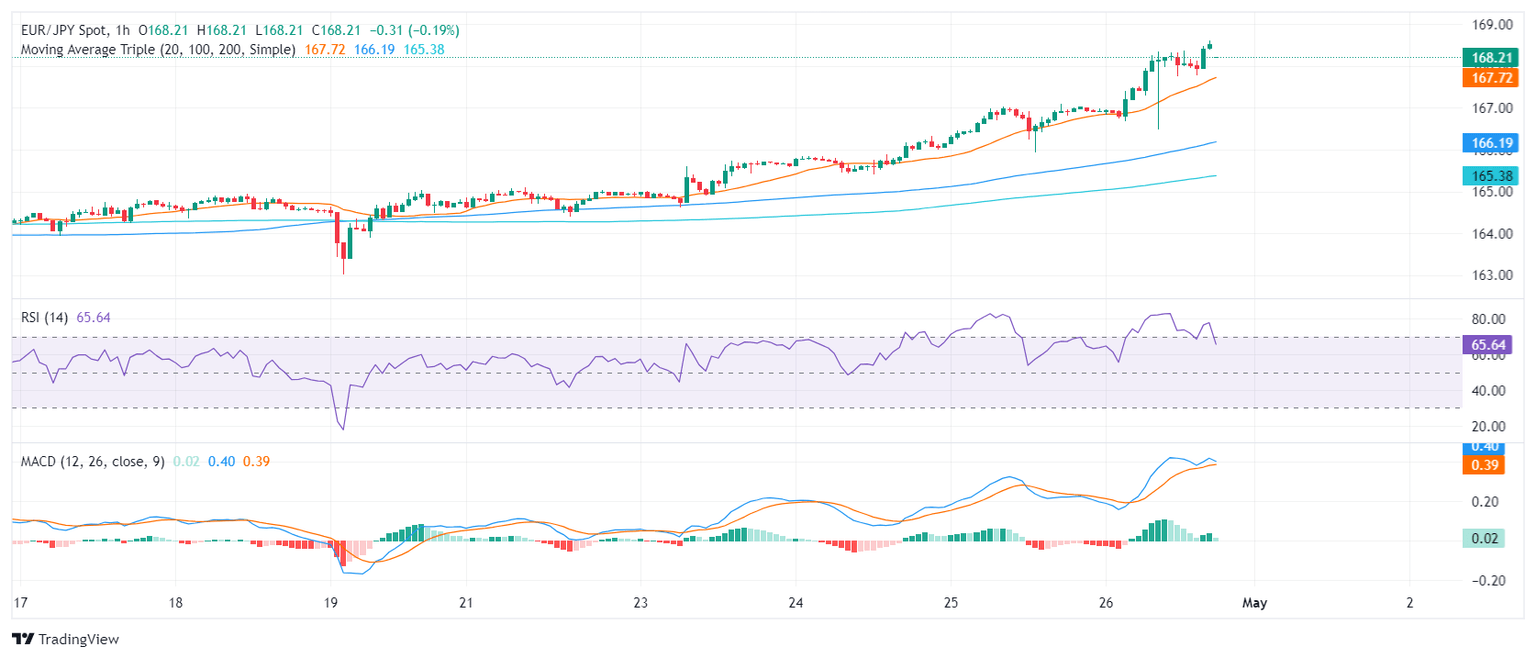

Transitioning to the hourly chart, the RSI oscillates largely within a positive range. Together with the MACD printing decreasing green bars, it shows mild fluctuations but overall remains in favor of the buying force throughout the session. Compared to the daily chart, there appears to be a concordance of bullish sentiment, but with the hourly outlook hinting at possible minor retractions.

EUR/JPY hourly chart

Regarding the broader outlook, it reveals that the EUR/JPY is trading above 20,100 and 200-day Simple Moving Averages (SMA). This still indicates the bull command not only in the short-term picture but significantly in the medium and long-term frames.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.