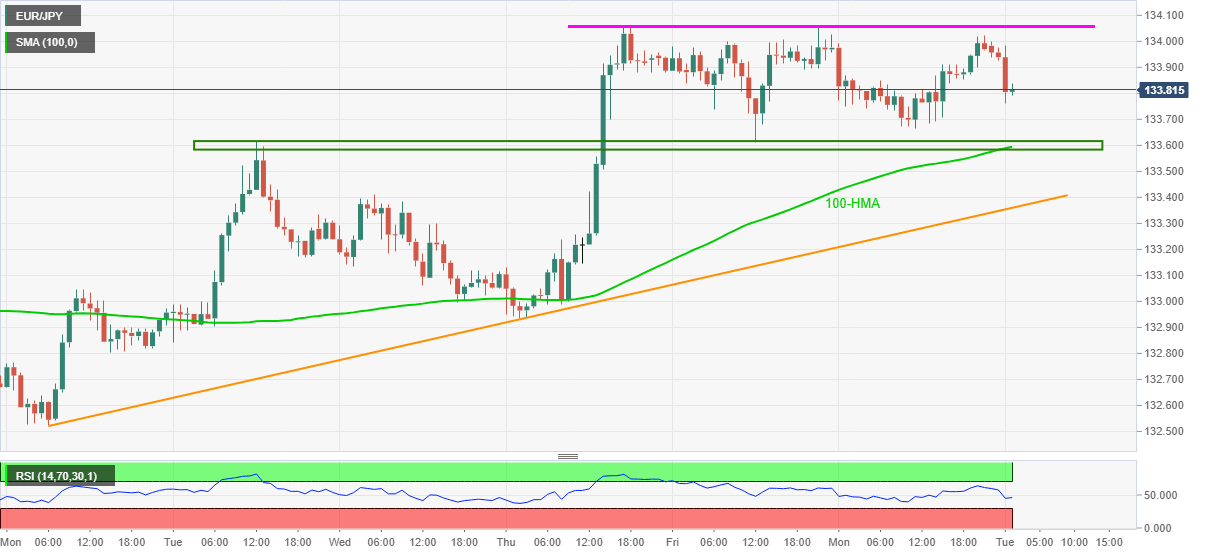

EUR/JPY Price Analysis: Bulls face rejection around 134.00

- EUR/JPY extends Monday’s pullback, pressured around intraday low.

- 100-HMA, weekly top test intraday sellers ahead of short-term rising trend line.

- Sustained rise past-134 back bulls to aim for late 2017 tops.

EUR/JPY remains on the back foot, down 0.14% intraday, around the day’s low of 133.76 during Tuesday’s Asian session. In doing so, the quote justifies repeated failures to cross 134.00.

However, normal RSI conditions highlight a one-week-old horizontal area surrounding 133.60, including 100-HMA and highs marked during the last Tuesday, as the key nearby support.

Also likely to test EUR/JPY sellers is an ascending support line from May 24, near 133.35.

It’s worth mentioning that the quote’s declines below the stated trend line support should direct the bears towards the May 21 swing low near 132.50.

Alternatively, an upside clearance of the 134.00 threshold on a daily closing basis will propel the EUR/JPY rally targeting the highs marked during September and October 2017, near 134.50-55.

In a case where the pair north-run remains intact beyond 134.55, the yearly high of 2018 near 137.50 will be in the spotlight

EUR/JPY hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.