EUR/JPY Price Analysis: Bearish indications dominate and sellers consolidate below the 20-day SMA

- The daily RSI and MACD reflect a negative trend, hinting at increasing selling pressure.

- Hourly chart indicators echo the bearish sentiment, with RSI around the 40 level and MACD showing a lack of buying momentum.

The EUR/JPY pair declined to 164.72 on Friday, reflecting subtle bears' influence with daily losses. Despite bearish signals in the daily short-term outlook, the pair's positioning above the key Simple Moving Averages (SMAs) hints at ongoing dominance by the buyers.

The daily chart reveals that the Relative Strength Index (RSI) fell into negative territory. The Moving Average Convergence Divergence (MACD) also depicts a bearish momentum with a series of rising red bars, suggesting that sellers are currently dominating the market.

EUR/JPY daily chart

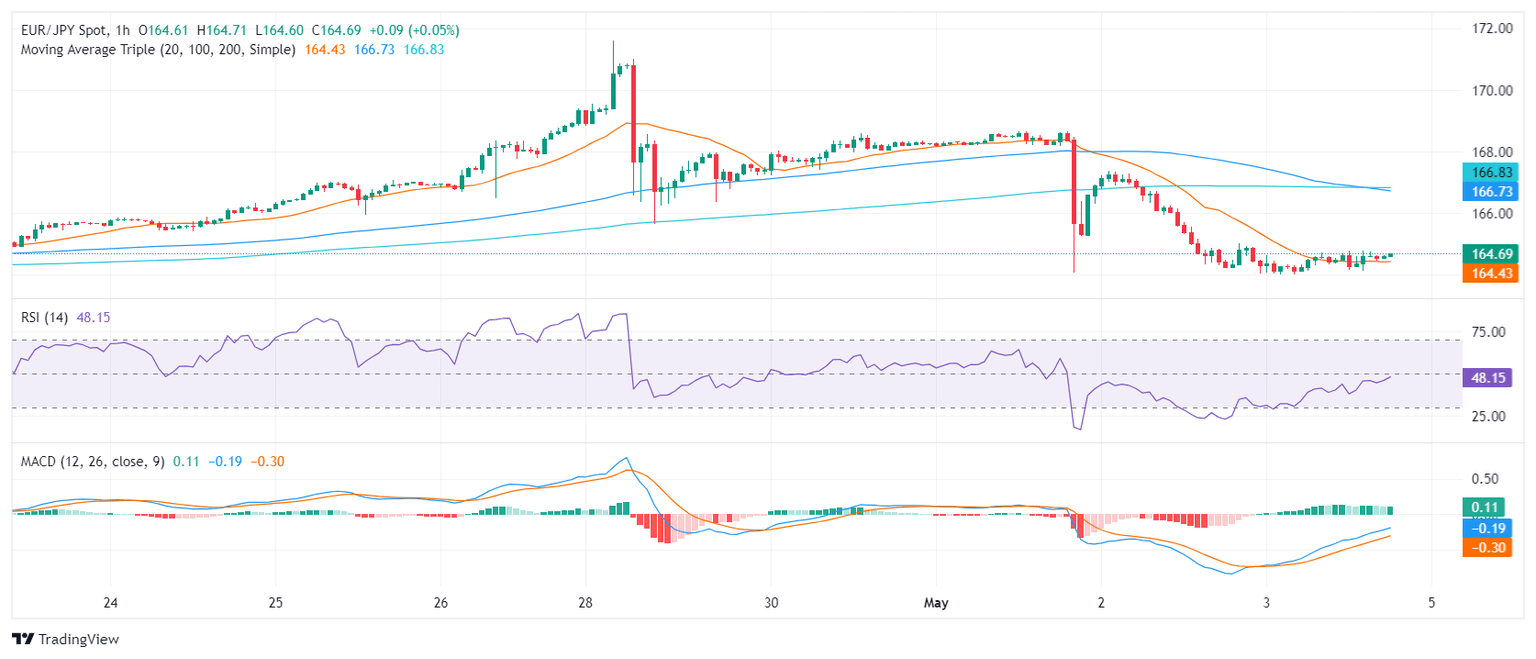

On the hourly chart, RSI continues to suggest a negative trend, hovering around the 40 levels, flirting with the oversold threshold, and showcasing the dominance of the sellers. The hourly MACD shows flat green bars, indicating a lack of strong momentum in these shorter time frames.

EUR/JPY hourly chart

Considering the overall market posture, the EUR/JPY is positioned above its longer-term Simple Moving Average (SMA) of 100, and 200-day periods. This usually signals a bullish momentum in both the medium and long term. However, the fall of the 20-day SMA means that the short-term outlook is painted with bearishness, and bears might attempt to reclaim the 100-day SMA at 161.70, which would definitely worsen the technical outlook in case of conquering.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.