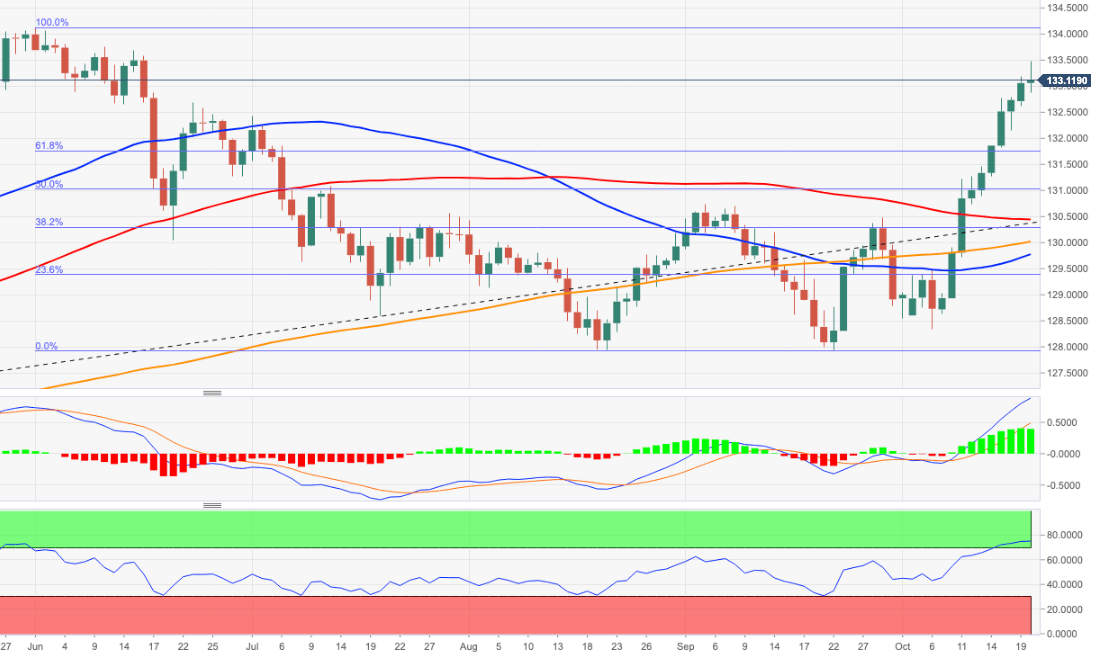

EUR/JPY Price Analysis: A test of YTD highs looms closer

- There is no respite for the strong rally in EUR/JPY for the time being.

- Bets are rising on a probable visit to the 2021 highs past 134.00 near term.

The intense move higher in EUR/JPY seems to have met some initial resistance around the 133.50 level so far on Wednesday.

The sharp move higher shows no signs of exhaustion so far, although the current overbought condition of the cross could trigger some consolidation or even a corrective move in the short-term horizon. Once digested one or the other, the cross should be able to resume the uptrend and attempt an assault to the YTD high at 134.12 recorded on June 1. Previously, there are minor hurdles at 133.68 (June 15) and 133.76 (June 10).

In the broader scenario, while above the 200-day SMA at 129.97, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.