EUR/JPY near YTD highs on tariff threats and political uncertainty in Japan

- EUR/JPY remains near YTD highs as tariff threats and political uncertainty weigh on the Yen.

- President Trump suggests that he remains open to trade talks with the EU while talks with Japan stagnate.

- EUR/JPY maintains a bullish posture with momentum indicators remaining in overbought territory.

The Euro (EUR) strengthened against the Japanese Yen (JPY) on Tuesday as investors rotated out of the Yen amid a mix of geopolitical and domestic policy concerns.

At the time of writing, EUR/JPY is trading near 172.73, edging lower after reaching a fresh YTD high of 173.08 earlier in the day.

A key driver behind the move is renewed US tariff threats, with President Donald Trump signaling higher reciprocal tariffs on imports from Japan and the European Union (EU), due to take effect on August 1.

While both economies may face longer-term headwinds from higher levies, which would raise costs for US importers and weigh on export-dependent sectors, the market reaction has been more negative for the Yen.

On Monday, President Trump indicated that he remains open to dialogue with the EU, but negotiations with Japan appear to have stalled, increasing the risk premium on Japanese assets and further dampening demand for JPY.

At the same time, political uncertainty ahead of Japan’s July 20 national election is clouding the policy outlook. Opposition parties are expected to advocate for more aggressive fiscal spending and continued monetary easing, which may limit the Bank of Japan’s ability to normalize interest rates in the near term. This has weakened market confidence in the Yen and further tilted momentum in favor of the Euro.

Taken together, rising global yields, political uncertainty in Japan, and firm Eurozone sentiment are supporting continued upside in EUR/JPY, though the pair now faces near-term resistance just below 173.00.

EUR/JPY maintains a bullish posture with momentum indicators remaining in overbought territory

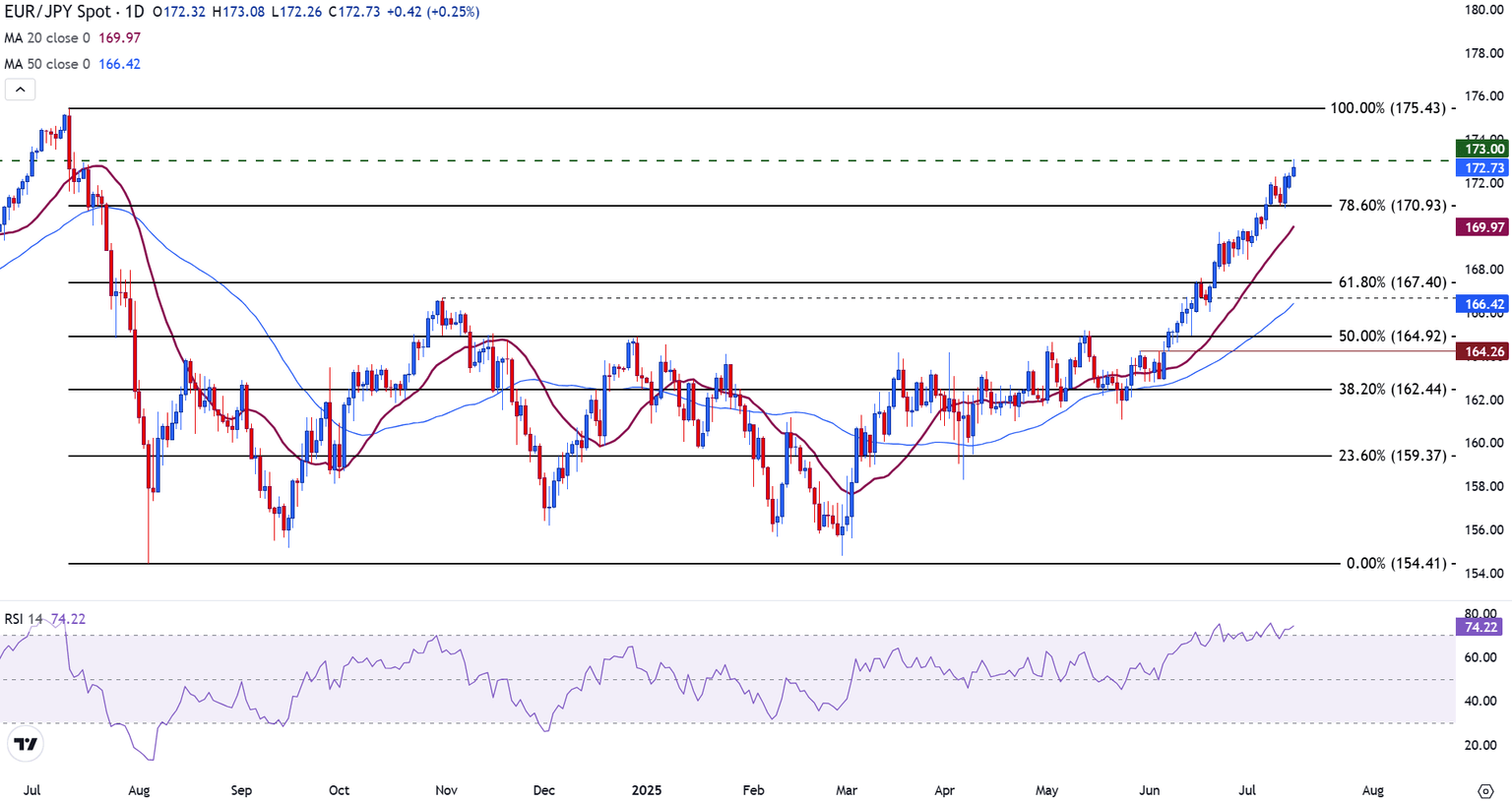

On the daily chart, EUR/JPY price action remains well-supported above both the 20-day Simple Moving Average (SMA) at 169.97 and the 50-day SMA at 166.42, reinforcing the underlying uptrend.

The pair recently bounced from the 78.6% Fibonacci retracement level of the longer-term July-August 2024 decline at 170.93, which now acts as immediate support.

A sustained break above the intraday high at 173.08 would confirm a bullish breakout, potentially targeting the July 2024 high of 175.43.

EUR/JPY daily chart

However, momentum appears stretched, with the Relative Strength Index (RSI) rising to 74, suggesting overbought conditions that could lead to a consolidation or shallow pullback before the next leg higher.

On the downside, a break below 170.93 would indicate waning bullish momentum and could trigger a corrective pullback. Below that, the next critical support lies at the 61.8% retracement around 167.40, which aligns with prior consolidation zones and the ascending 50-day SMA.

A move below this region would suggest a broader shift in sentiment and potentially expose the 165.00 handle.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.