EUR/GBP spikes as markets cheer potential EU-US trade deal

- EUR/GBP surges above prior psychological resistance at 0.8400.

- Europe and the United States take steps toward a trade deal, boosting optimism.

- EUR/GBP moves toward key 78.6% Fibonacci resistance level.

The Euro (EUR) is trading higher against the Pound Sterling (GBP) on Thursday, buoyed by news that the European Union (EU) and the United States (US) are making progress in trade talks.

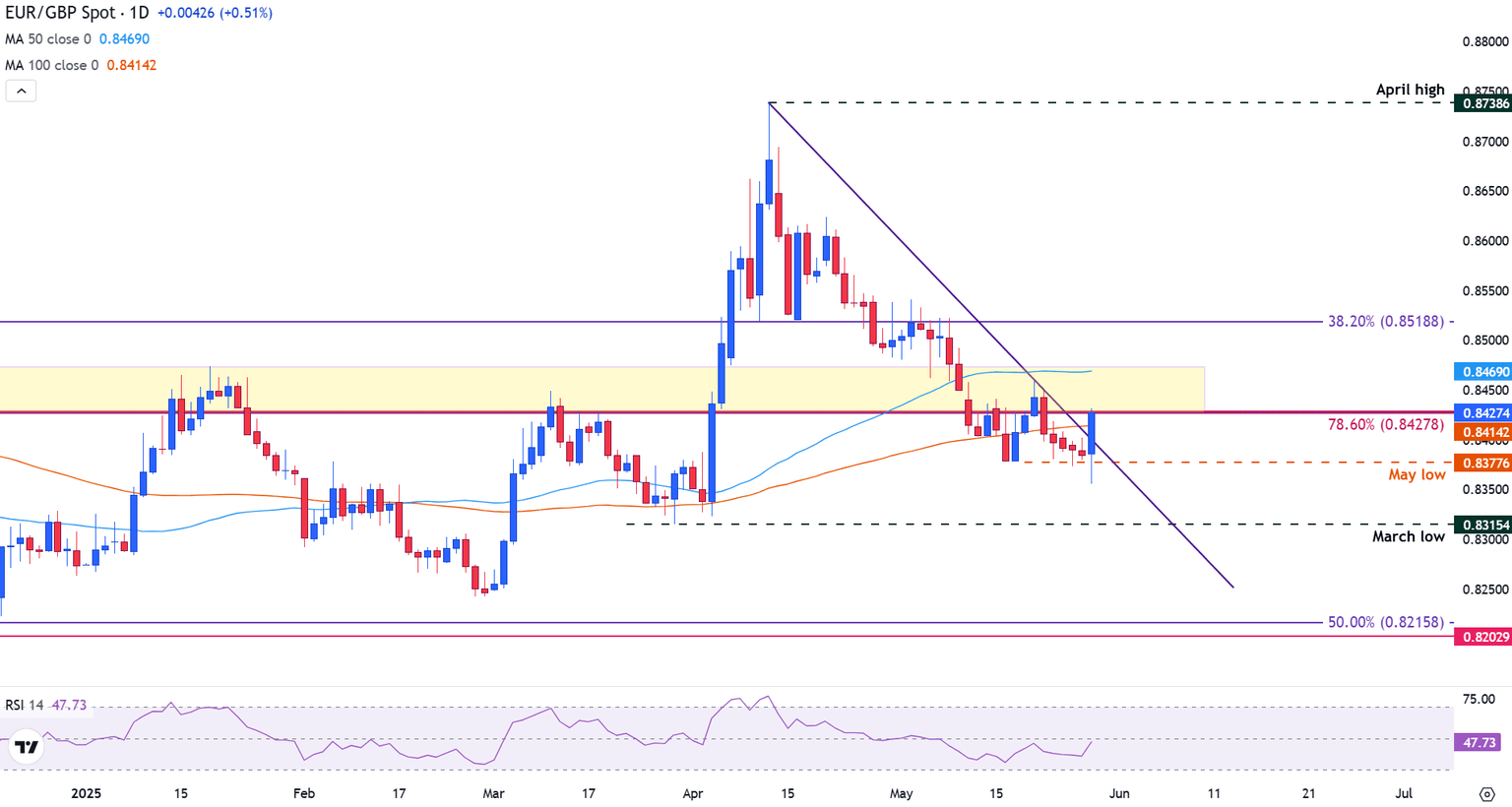

At the time of writing, EUR/GBP is trading above the 100-day Simple Moving Average (SMA) and is firmly supported above the key psychological level of 0.8400.

EU-US trade deal optimism boosts demand for the Euro

With US President Donald Trump’s sweeping tariffs facing scrutiny by a US Federal Court, the Trump administration continues to appeal for tariffs to be imposed on major trading partners of the United States.

For the European Union, the 50% tariff threat announced by Trump last Friday sent markets into turmoil. However, the administration has appeared to have fast-tracked negotiations between the two nations.

Despite economic data out of the EU highlighting the fragility of the economy over recent weeks, EU Trade Commissioner Maroš Šefčovič and US officials, including Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer, appear to be making progress in their negotiations.

The EU has proposed a "zero-for-zero" tariff arrangement on industrial goods, including automobiles, and is open to increasing imports of US products such as soybeans, liquefied natural gas, and defense equipment.

Meanwhile, Trump is pushing for the EU to revise or remove specific non-tariff barriers, such as food safety regulations and digital services taxes, that the Trump administration considers impediments to fair and reciprocal trade.

ECB and BoE monetary policy divergence appears to be narrowing, supporting EUR/GBP

Additionally, monetary policy divergence between Europe and the United Kingdom appears to be narrowing.

According to a recent poll released by Reuters, 70% of economists anticipated the ECB to announce another 25 bps (0.25%) rate cut in June, with expectations that rates would remain steady thereafter.

Despite recent economic data out of the Eurozone this week warning that the economy is under pressure, technical levels have provided an additional catalyst for the EUR/GBP pair.

With a steady appreciation in today’s session pushing prices toward 0.8428, this level aligns with the 78.6% Fibonacci retracement (Fib) level of the March-September 2022 move and has served as both support and resistance for prior historical moves.

EUR/GBP daily chart

GDP FAQs

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022. Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency. When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.