EUR/GBP Price Forecast: Resumes downside bias

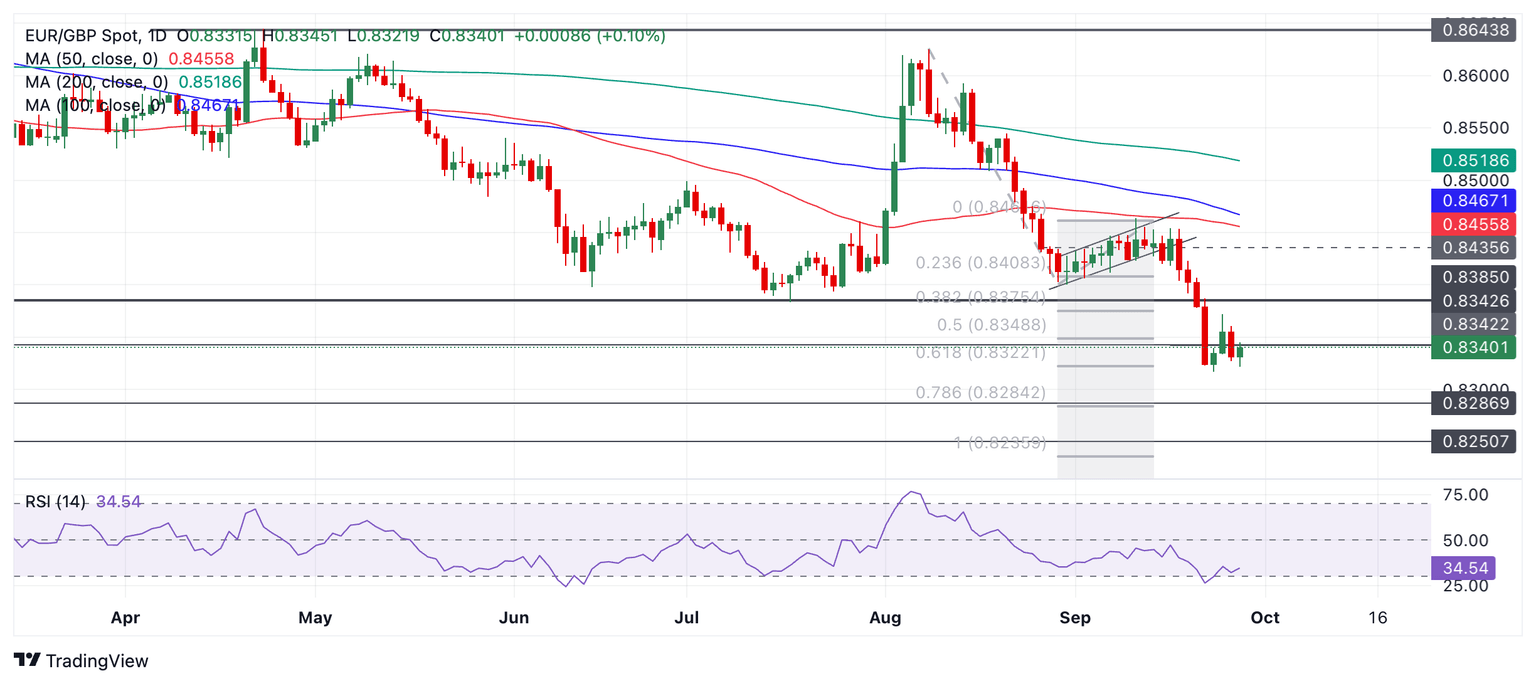

- EUR/GBP appears to have stalled after pulling back higher from the September 24 lows.

- The pair may be resuming its downtrend and could break lower.

EUR/GBP stalls in its pull back from the September 24 lows and resumes its downside bias.

The pair is in a short and medium-term downtrend which given the technical analysis theory that “the trend is your friend” is more likely than not to continue.

EUR/GBP Daily Chart

That said, EUR/GBP has now reached the first downside target for the bear move that began at the August 5 high and this could indicate the end of its decline. The target is the 61.8% extrapolation of the initial move down during August before the channel that formed in early September.

A break below the 0.8317 September 24 low would reconfirm a continuation of the downtrend towards the next target at 0.8287, the August 2022 low.

The Relative Strength Index (RSI) exited oversold after the bounce on September 24 and this could indicate the risk that a stronger correction may still unfold higher.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.