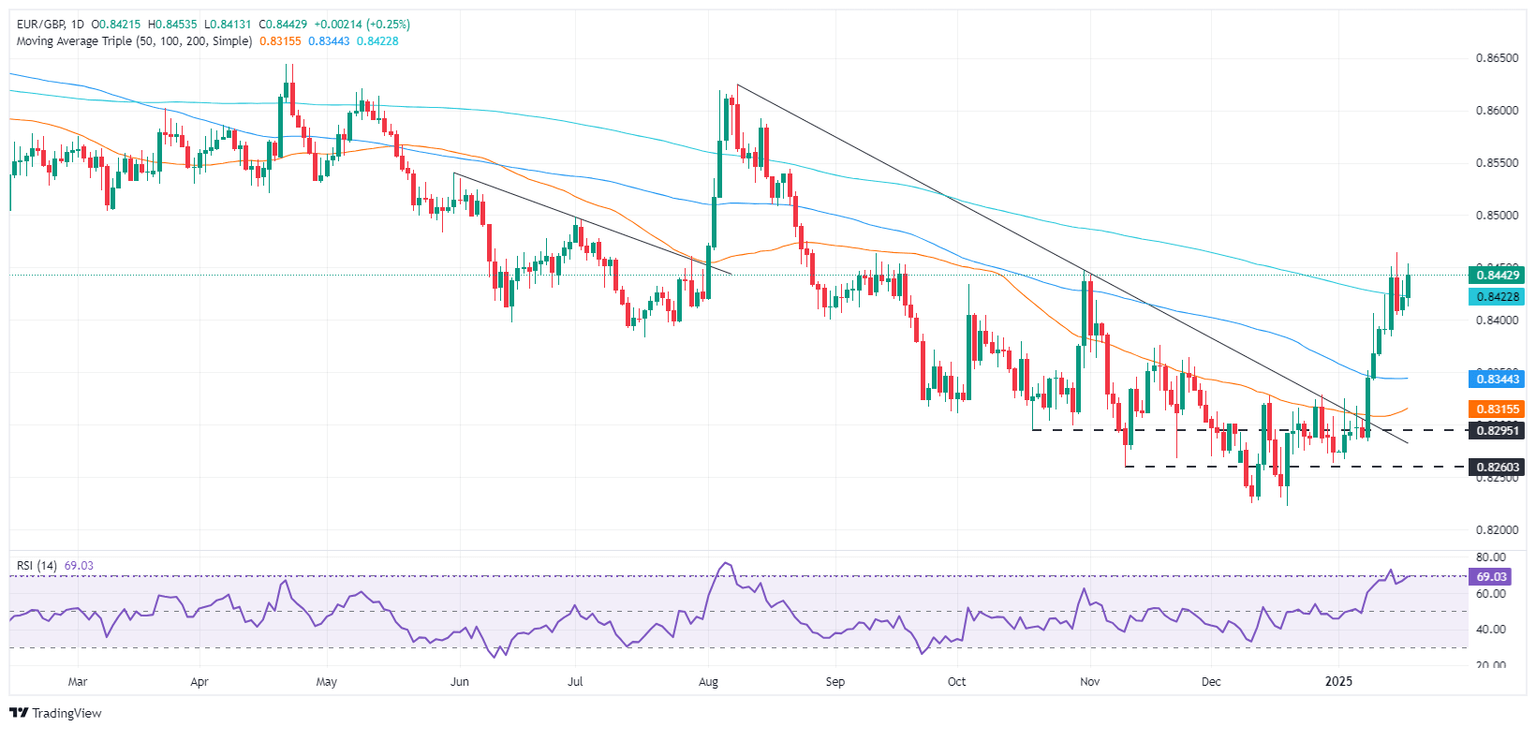

EUR/GBP Price Forecast: Climbs above 200-day SMA shows bullish momentum

- Euro strengthens, trades above 200-day SMA at 0.8425, signaling bullish momentum against Pound.

- Bulls target January 15 high at 0.8463; breaking this could extend to 0.8500 and higher.

- If EUR/GBP falls below 200-day SMA, may drop to 0.8400, with support at January 14 low of 0.8383.

The Euro extended its gains versus the Pound Sterling on Friday, posting back-to-back bullish bars and climbing above the crucial 200-day Simple Moving Average (SMA) at 0.8425. This indicates bullish momentum is building as the EUR/GBP trades at 0.8443.

EUR/GBP Price Forecast: Technical outlook

Bulls are in charge but must clear the January 15 peak at 0.8463. Once surpassed, the next stop will be 0.8500. A breach of the latter will expose intermediate resistance at the August 21 peak of 0.8544, followed by the August 14 high at 0.8593.

Conversely, if EUR/GBP falls below the 200-day SMA, sellers can challenge 0.8400. On further weakness, the next support will be the January 14 low of 0.8383.

EUR/GBP Price Chart - Daily

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.18% | 0.45% | 0.45% | 0.26% | 0.40% | 0.50% | 0.31% | |

| EUR | -0.18% | 0.26% | 0.27% | 0.07% | 0.22% | 0.31% | 0.13% | |

| GBP | -0.45% | -0.26% | 0.02% | -0.19% | -0.04% | 0.04% | -0.13% | |

| JPY | -0.45% | -0.27% | -0.02% | -0.18% | -0.05% | 0.05% | -0.13% | |

| CAD | -0.26% | -0.07% | 0.19% | 0.18% | 0.13% | 0.23% | 0.06% | |

| AUD | -0.40% | -0.22% | 0.04% | 0.05% | -0.13% | 0.09% | -0.10% | |

| NZD | -0.50% | -0.31% | -0.04% | -0.05% | -0.23% | -0.09% | -0.18% | |

| CHF | -0.31% | -0.13% | 0.13% | 0.13% | -0.06% | 0.10% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.