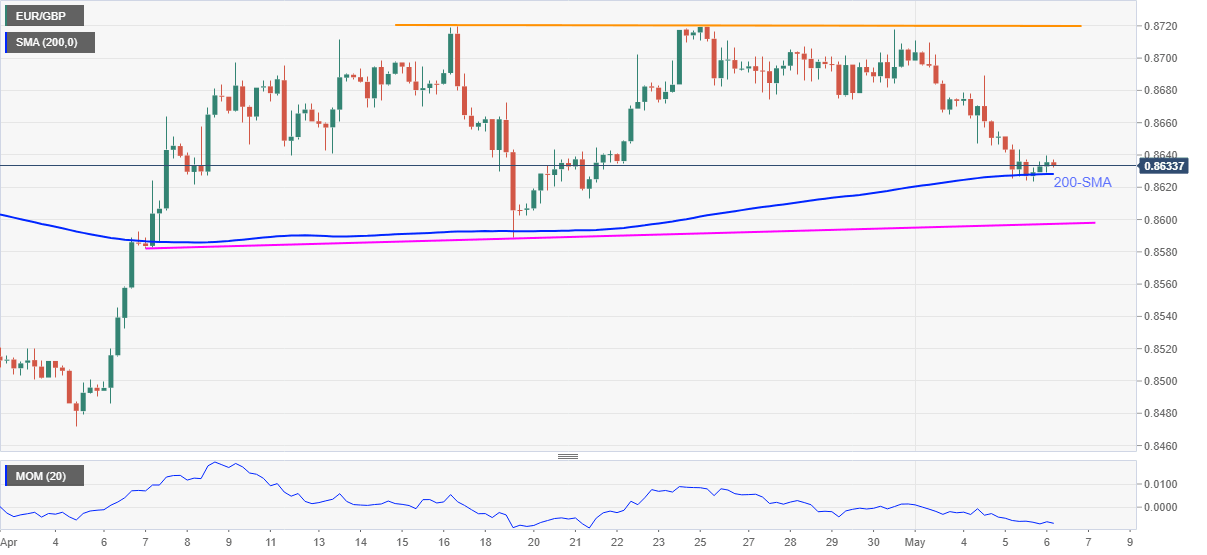

EUR/GBP Price Analysis: Sellers flirt with 200-SMA to remain above 0.8600

- EUR/GBP wobbles around the key SMA, dropped recently.

- Downbeat Momentum indicator signals, pending confirmation of ‘double-top’ test bears.

Despite staying near a two-week low, EUR/GBP bears are cautious as the quote prints 0.8635 figures on the chart while heading into Thursday’s European open. In doing so, the cross-currency pair prints a corrective pullback from the 200-SMA level amid a sluggish Momentum line.

Not only 200-SMA level of 0.8628 but a one-month-old ascending trend line near 0.8600 and April 19 bottom surrounding 0.8588 also question EUR/GBP seller’s ruling.

It should, however, be noted that the pair’s sustained break of 0.8588 will confirm the ‘double top’ bearish chart pattern and can probe the previous month’s low near 0.8470.

Meanwhile, late April lows near 0.8675 seem to lure short-term EUR/GBP buyers before pushing them to the 0.8720 hurdle.

Also acting as the upside filter, beyond 0.8720, is the early February low ear 0.8740.

It's worth noting that the pair's latest moves could be traced to upbeat German Factory Orders for March as well as cautious sentiment ahead of Eurozone Retail Sales and the BOE, not to forget local elections in the UK.

EUR/GBP four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.