EUR/GBP Price Analysis: Sellers attack June’s top with eyes on UK CPI

- EUR/GBP refreshes weekly low while declining for the third day in a row.

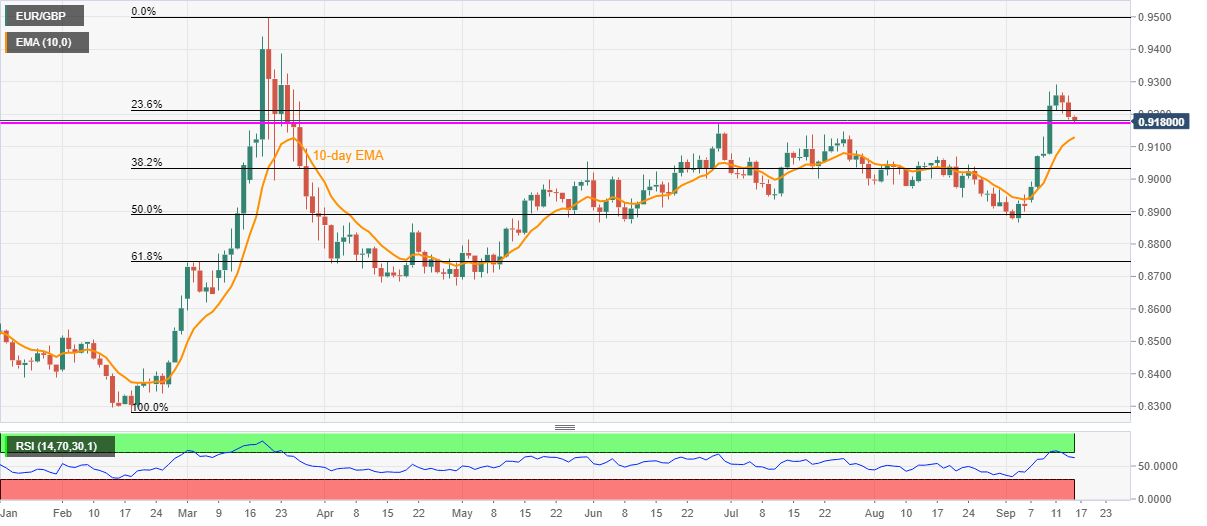

- Multiple highs marked in July, 10-day EMA lures the bears.

- Consolidation of overbought RSI suggests further weakness in EUR/GBP prices unless breaking 0.9300.

- UK CPI is expected to recede from prior 1.0% YoY to 0.0% in August.

EUR/GBP fades pullback from 0.9172 around 0.9180 amid the pre-European session open trading on Wednesday. In doing so, the quote portrays the cautious sentiment ahead of the UK’s Consumer Price Index (CPI) data for release for August, up for publishing at 06:00 GMT.

Even so, a retracement of the overbought conditions, as per the RSI, suggests the further weakness of the EUR/GBP prices.

While portraying the same, the pair traders may conquer June month’s high of 0.9175 to aim for multiple highs marked in July around 0.9145/40.

It should, however, be noted that the 10-day EMA near 0.9130 and the 0.9100 threshold can question the quote’s further weakness.

Meanwhile, the monthly top of 0.9291, followed by 0.9300 round-figures, can continue challenging the EUR/GBP buyers ahead of directing them to the yearly peak of 0.9499.

EUR/GBP daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.