EUR/GBP Price Analysis: Recovery gains momentum, technical outlook mixed

- EUR/GBP has extended its recovery from last week's lows, with technical indicators showing signs of improvement.

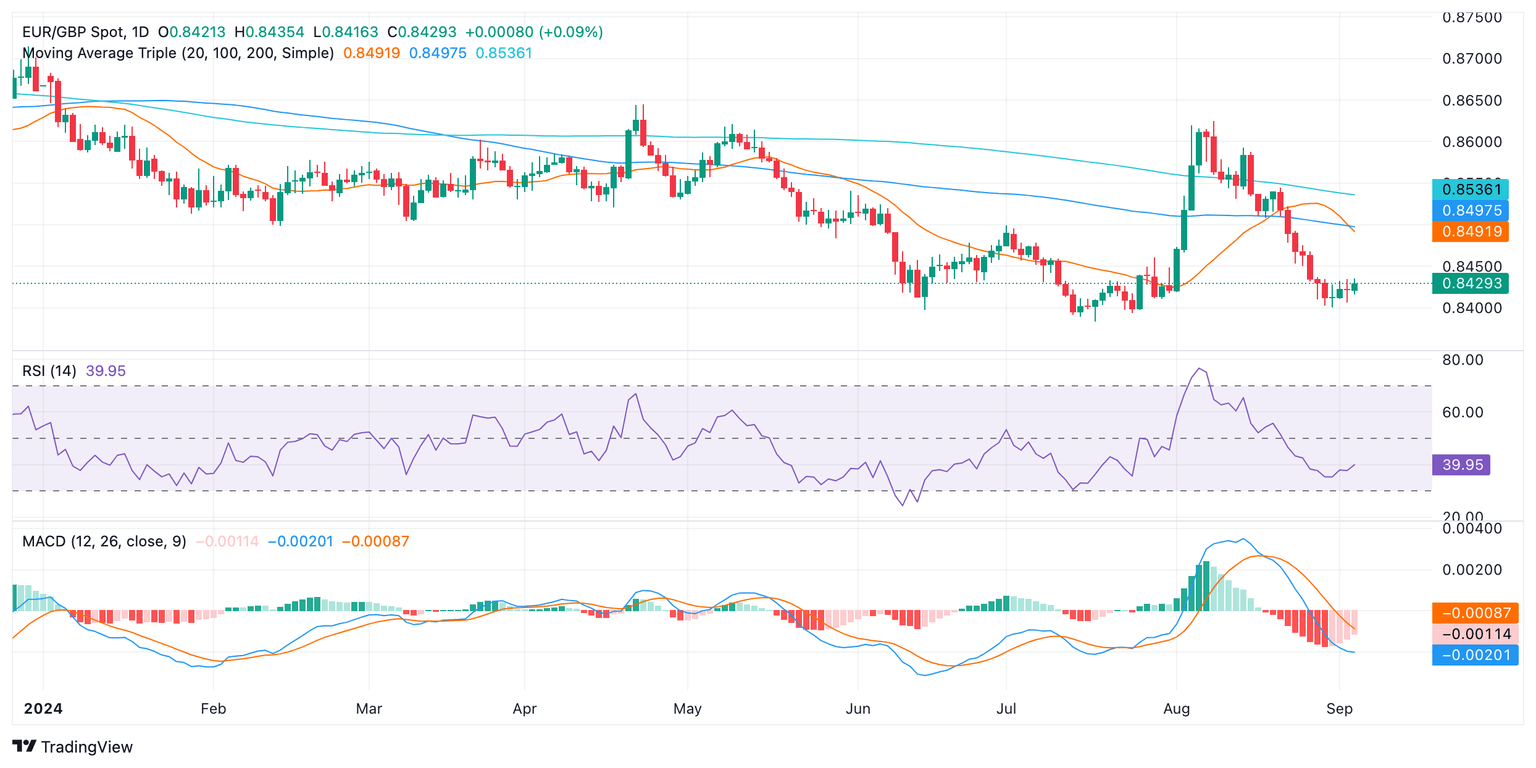

- Mixed signals from RSI and MACD, overall neutral outlook.

- The pair might continue side-ways trading in the next sessions above 0.8400.

In Wednesday's session, the EUR/GBP mildly rose to 0.8420, continuing its recovery from last week's losses which saw the cross bottoming at 0.8400.

The Relative Strength Index (RSI) remains in negative territory, indicating that bears have the upper hand. However, the RSI's slope is rising, suggesting that bullish momentum is building. The Moving Average Convergence Divergence (MACD) prints decreasing red bars, also pointing out that the bears are losing steam.

The EUR/GBP pair seems to be consolidating above the 0.8400 level, which acts as immediate support while resistances line up at 0.8430, 0.8450, and above at 0.8470. With that in mind, it all points out that the bears are taking a breather after last week's movements and that the cross has entered in consolidation mode.

EUR/GBP daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.