EUR/GBP Price Analysis: Range-bound pair, with mixed technical outlook

- EUR/GBP remains sideways, technical indicators are mixed.

- Buyers got rejected by the 20-day SMA.

- Indicators suggest a neutral to slightly bullish bias.

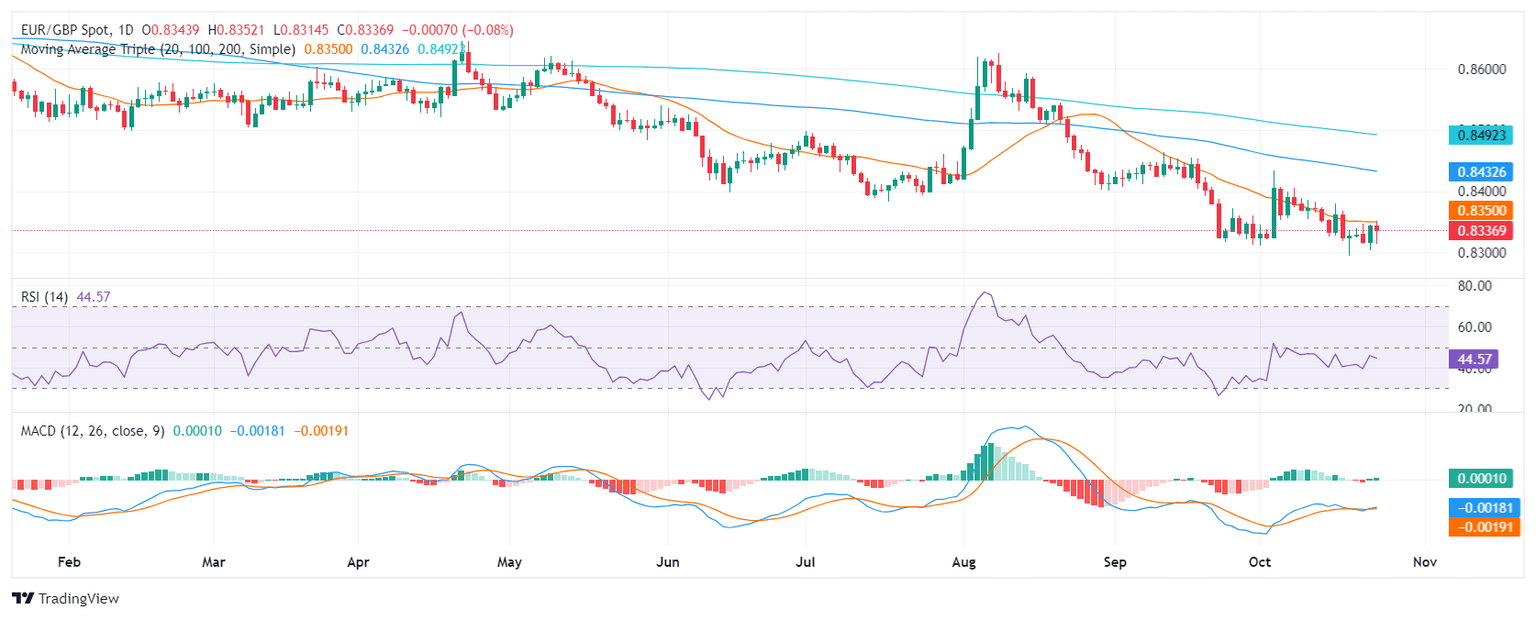

The EUR/GBP pair has been trading in a narrow range over the past few days, with minimal price fluctuations. The pair is currently trading at 0.8335, slightly lower than its opening price for the day after getting rejected by the 20-day Simple Moving Average (SMA).

Technical indicators are sending mixed signals. The Relative Strength Index (RSI) is hovering around 44, indicating that selling pressure is rising as it points down. However, the Moving Average Convergence Divergence (MACD) is green and rising, suggesting that buying pressure is also increasing. The overall short-term outlook is mixed, with the RSI indicating a bearish trend and the MACD indicating a bullish recovery.

In terms of support and resistance levels, support can be identified at 0.8330, 0.8315, and 0.8300, while resistance levels stand at 0.8350, 0.8370 and 0.8400. The pair is likely to continue trading within this range in the near term if the buyers are unable to conquer the 20-day SMA at 0.8350.

EUR/GBP daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.