EUR/GBP Price Analysis: Mixed signals from indicators, eyes on bullish crossover

- EUR/GBP marginally rose to 0.8520 after two sessions of losses.

- Technical indicators present a neutral outlook for the short term.

- Traders should track a potential bullish crossover between the 20 and 100-day SMA at around 0.8500.

Monday's trading saw the EUR/GBP pair fluctuate within a narrow range, with a marginal rise to 0.8520. This movement followed a two-day losing streak for the pair.

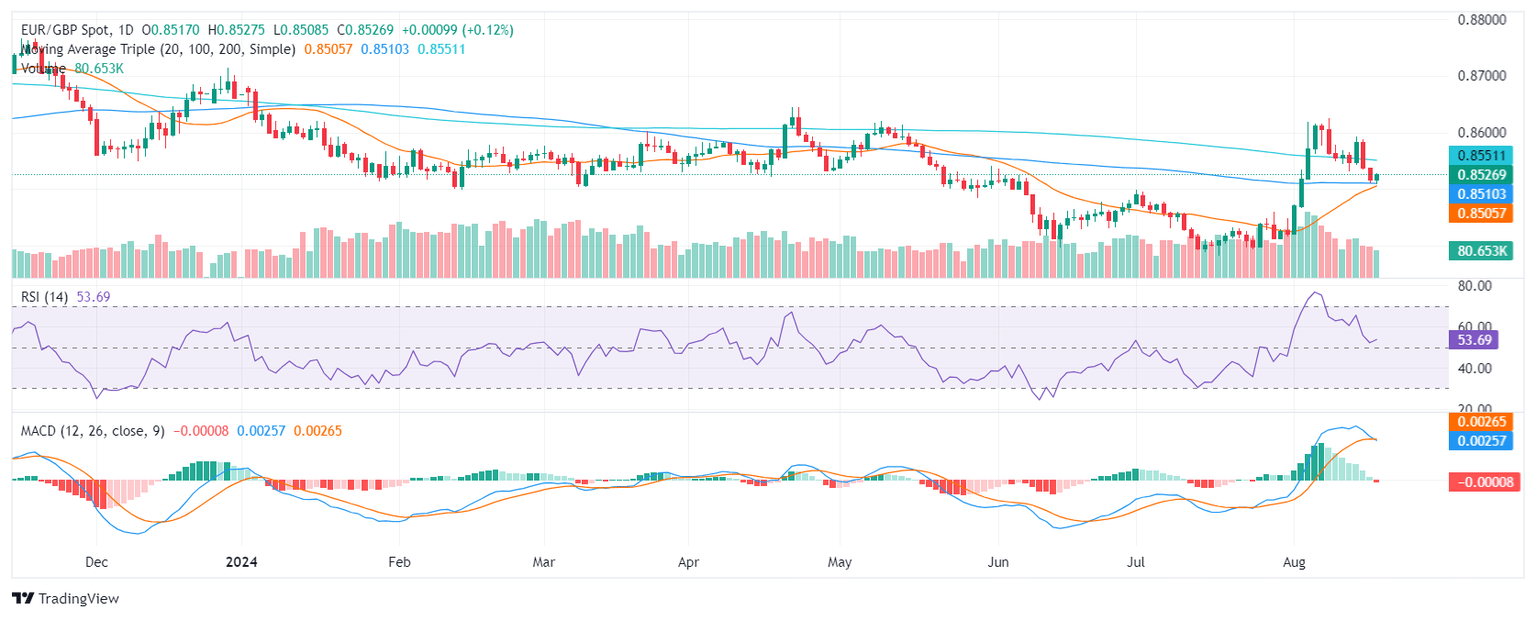

The EUR/GBP pair suggests a mix of bullish and bearish signals. The Relative Strength Index (RSI) is currently at 53, indicating a slight upward trend in buying pressure. However, the Moving Average Convergence Divergence (MACD) has printed a fresh red bar, suggesting a potential shift towards bearish momentum. Volume patterns have been mixed, with recent sessions exhibiting lower volume compared to large spikes observed earlier in the month.

EUR/GBP daily chart

The EUR/GBP pair has been consolidating within a range of 0.8500-0.8550 for the last few sessions. A breakout above 0.8550 could indicate a potential bullish trend, while a break below 0.8500 may increase the likelihood of further downward movement. Key support levels to watch include 0.8450 and 0.8400, while resistance levels to consider include 0.8580 and 0.8600.

A bullish catalyst might be a crossover about to be completed between the 20 and 100-day Simple Moving Averages (SMA) at around 0.8500. This could firstly propel the pair upwards as well as build support around the mentioned psychological level.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.