EUR/GBP Price Analysis: MACD flashes early signals for sellers

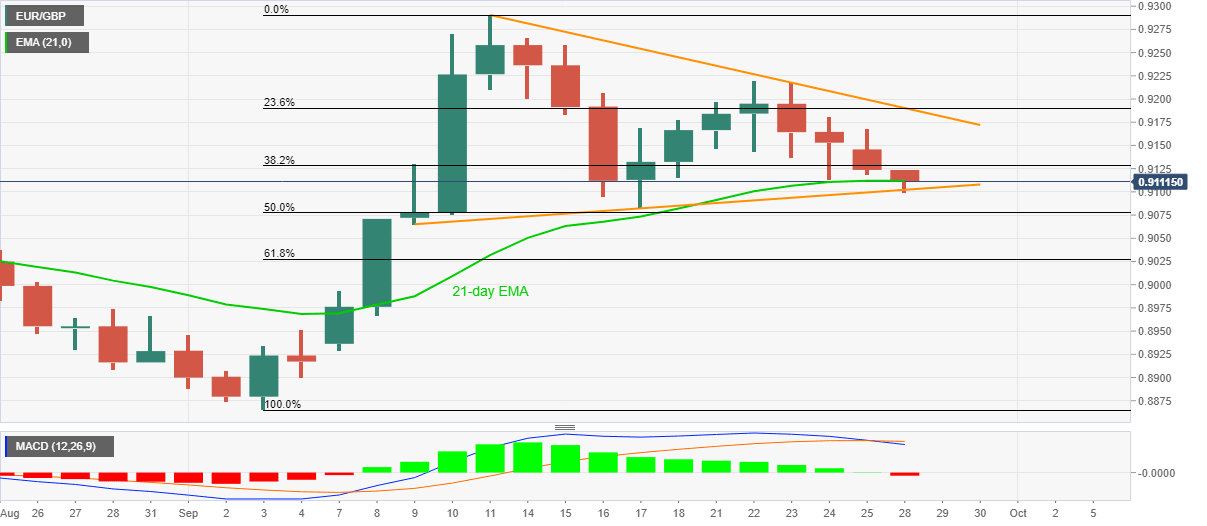

- EUR/GBP struggles to keep recovery moves from 0.9100, drops for the fourth day in a row.

- MACD turns bearish for the first time in three weeks.

- Short-term symmetrical triangle restricts immediate moves.

EUR/GBP prints mild losses of 0.12% while staying depressed around 0.9110 during the pre-European trading on Monday. While a triangle formation since September 09 questions the pair’s immediate moves, bearish MACD signals favor the sellers.

As a result, a daily closing below the triangle’s support line, currently around 0.9100 becomes necessary to confirm the further weakness of EUR/GBP.

Following that, 50% and 61.8% Fibonacci retracement of the early month’s upside, respectively around 0.9075 and 0.9025, could please the bears ahead of 0.8930 and the monthly low of 0.8866.

In a case where EUR/GBP keeps its daily closing beyond the 21-day EMA level of 0.91118, intraday buyers may aim for 0.9145/50 resistances.

However, a falling trend line from September 11, at 0.9190 now, could keep the bulls chained afterward.

EUR/GBP daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.