EUR/GBP Price Analysis: Euro drifts near 0.8500 as bearish pressure builds

- EUR/GBP trades near the 0.8500 zone after slipping modestly in Friday’s session.

- Short-term signals remain bearish despite mixed long-term support.

- Key support levels hold below, while resistance aligns just overhead.

The EUR/GBP pair edged lower on Friday, trading near the 0.8500 zone after the European session as selling pressure remained consistent. The pair settled within the middle of its daily range, reflecting cautious sentiment despite the broader bearish tone. Short-term signals continue to weigh on the pair, while longer-term moving averages offer a more supportive backdrop.

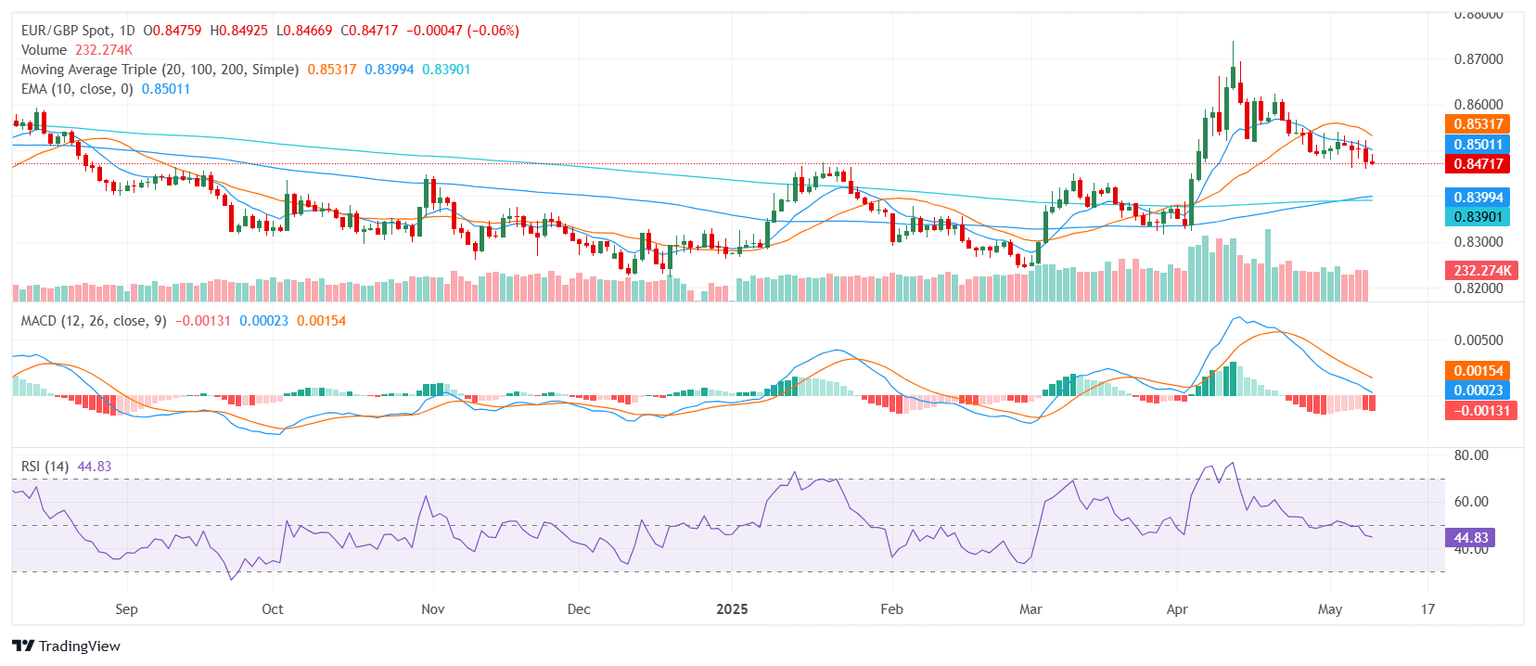

Technically, the pair is flashing a bearish overall signal. The Relative Strength Index (RSI) is neutral near 45, suggesting balanced momentum without immediate directional conviction. The Moving Average Convergence Divergence (MACD) prints a clear sell signal, confirming the downside bias, while the Stochastic RSI Fast also holds neutral, reflecting a lack of short-term directional strength. Meanwhile, the Average Directional Index remains neutral, indicating that the bearish trend lacks significant strength at the moment.

The short-term moving averages add to the downside pressure. Both the 10-day Exponential and Simple Moving Averages are positioned above the current price and slope downward, reinforcing immediate resistance. Similarly, the 20-day Simple Moving Average remains above spot and trends lower, further capping recovery attempts. In contrast, the longer-term 100-day and 200-day Simple Moving Averages sit well below current levels and continue to point upward, suggesting that broader structural support remains intact despite the short-term weakness.

Support levels are identified at 0.8470, 0.8461, and 0.8430. Resistance stands at 0.8483, 0.8497, and 0.8497. A sustained break below the immediate support zone could deepen the sell-off, while a move above resistance would be needed to challenge the prevailing bearish outlook.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.