EUR/GBP Price Analysis: EUR/GBP broke above the 100-DMA, buyers target 0.8600

- EUR/GBP printed a weekly high at 0.8594.

- The pair broke the 100-DMA on Monday, suggesting buyers are in control.

- As the spot price remains beneath the 200-DMA, downward pressure stills in play.

The EUR/GBP is advancing for the third day in a row, trading at 0.8593, up 0.08% at the time of writing. The market sentiment is upbeat after Monday’s selloff due to Evergrande’s woes and its possibilities of defaulting the interest payments on Thursday.

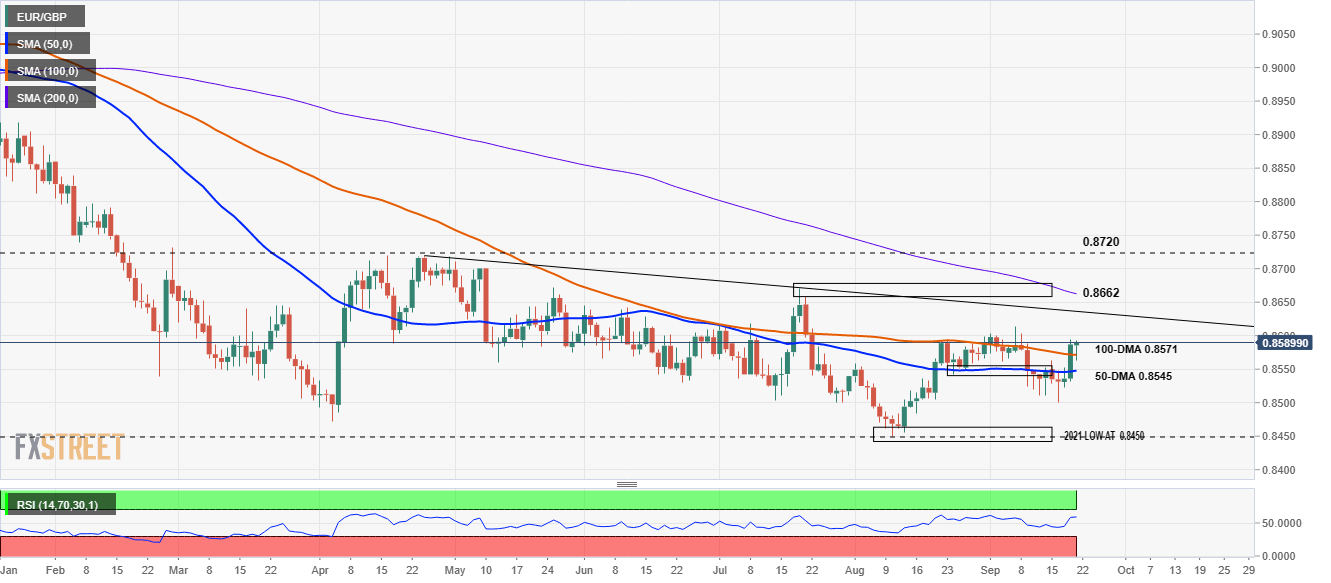

EUR/GBP daily chart

The pair bounced off the 100-day moving average (DMA) at 0.8571, approaching the weekly high printed on Monday nearby 0.8600. A daily break above 0.8600 will open the door for further gains. The first resistance level would be a downslope trendline, around the 0.8630-50 range. Once that level is cleared, the next supply zone would be the confluence of the July 20 high and the 200-DMA within the 0.8660-68 range, followed by the April 26 high at 0.8720.

On the flip side, failure at 0.8600 the EUR/GBP could slide towards the 100-DMA. A break of that level would expose the 50-DMA at 0.8545 followed by the September 16 low at 0.8500. A decisive breach of that level could push the price towards 2021 lows at 0.8450.

KEY TECHNICAL LEVELS TO WATCH

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.