Elliott Wave View: Nifty reacting higher after three swing pullback [Video]

![Elliott Wave View: Nifty reacting higher after three swing pullback [Video]](https://editorial.fxstreet.com/images/Markets/Equities/financial-figures-7116094_XtraLarge.jpg)

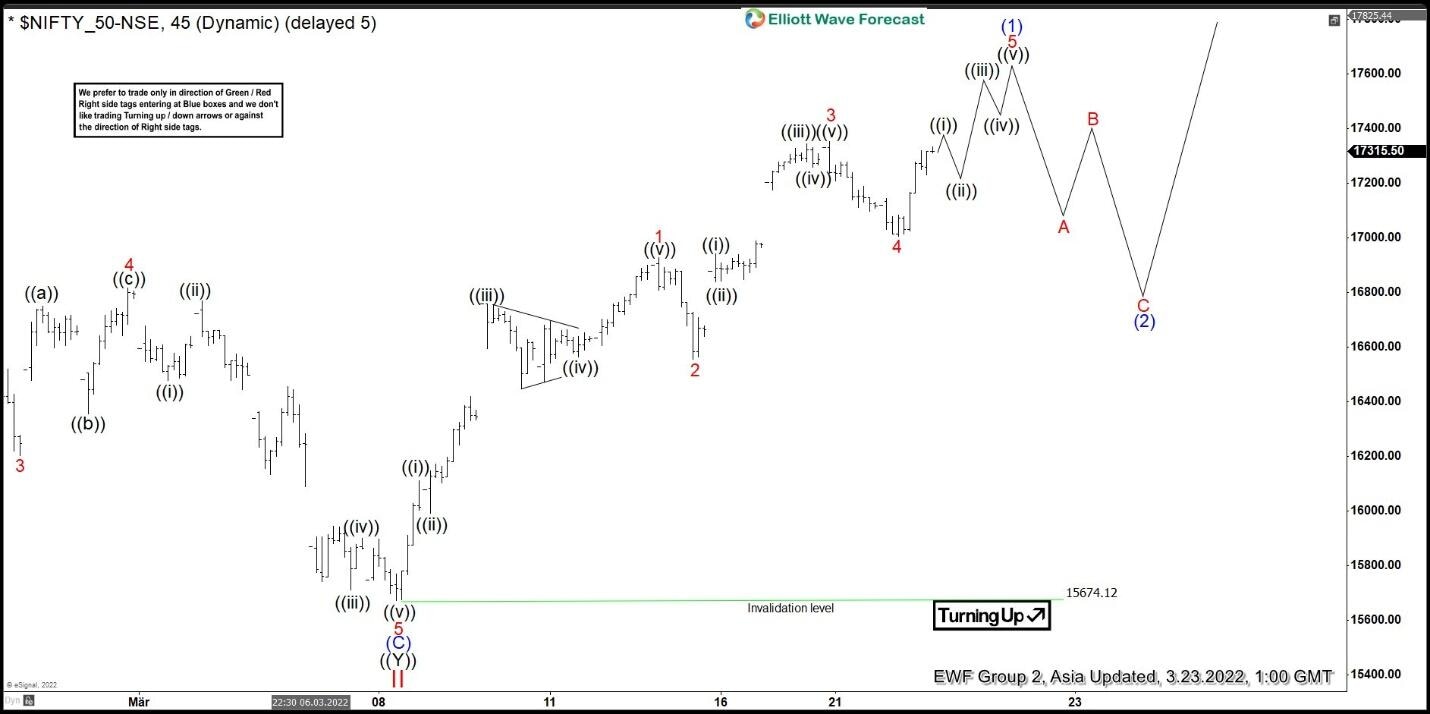

After forming the top on October 19, 2021 peak at 18604.45, Nifty has been correcting lower in 3 swing. It reached the 100% – 123.6% extension area at 15638 – 16156 from October 19, 2021 and the Index reacts higher strongly. In the 45 minutes chart below, we are calling wave II correction ended at 15674.12. This is a correction to the cycle from March 24, 2020 low. The Index has started a new bullish leg in wave III with internal subdivision as a 5 waves impulse. However, it still needs to break above October 19, 2021 peak at 18604.45 to rule out any double correction.

Up from wave II low on March 8, wave 1 ended at 16927.75 and pullback in wave 2 ended at 16555. Index then resumed higher in wave 3 towards 17353.35 and pullback in wave 4 ended at 17006.30. Expect Index to see further upside in wave 5 before it completed wave (1) and ends cycle from March 8 low. Afterwards, expect a pullback in wave (2) to correct cycle from March 8 low before the rally resumes. Near term, as far as wave II pivot low at 15674.12 holds, expect pullback to find support in the sequence of 3, 7, or 11 swing for further upside.

Nifty 45 minutes Elliott Wave chart

Nifty Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com