Elliott Wave analysis on SPX looking to extend higher in impulsive structure [Video]

![Elliott Wave analysis on SPX looking to extend higher in impulsive structure [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse4-637299025173341169_XtraLarge.jpg)

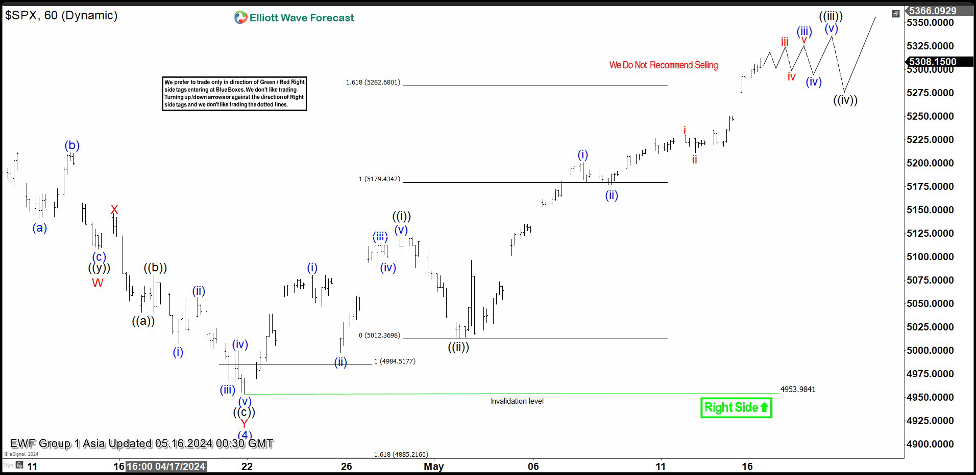

Short term Elliott Wave in SPX suggests that the Index ended wave (4) pullback at 4953.98. From there, it rallies higher in wave (5) as a nesting impulse Elliott Wave structure. Up from wave (4), wave ((i)) ended at 5121.45 and dips in wave ((ii)) ended at 5013.45. The Index is nesting higher within wave ((iii)). Up from wave ((ii)), wave (i) ended at 5200.23 and pullback in wave (ii) ended at 5176.63. Wave (iii) higher is still developing.

We can see another nest formed as part of wave (iii). Up from wave (ii), wave i finished at 5229.58 and pullback in wave ii ended at 5211.16. Then, SPX did a strong rally making an all-time-high breaking March peak. Expect the index moving sideways-higher to complete groups of waves 4s and 5s until wave ((iii)) is finished. Right now, there is not a potential target for wave ((iii)). A strong pull back in the index would suggest that wave ((iii)) has ended and wave ((iv)) correction has started. Then, expect to find support for further upside in wave ((v)). Near term, as far as pivot at 4953.9 low stays intact, expect pullback to find support in 3, 7, 11 swing for further upside.

SPX 60 minutes Elliott Wave chart

SPX Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com