Elliott Wave analysis: META hits new high from blue box

Meta Platforms, formerly Facebook, is a tech company focused on building the “metaverse.” It owns Facebook, Instagram, and WhatsApp, and develops virtual reality (VR) and augmented reality (AR) products. $META is one of the 26 instruments we cover for members in Group 2.

After a significant decline of over 77% from its July 2021 record high, the stock has since delivered one of the best gains in the past two years. From the January 2023 lows, it has surged around 500% in a clear bullish sequence. When price is trending in a bullish sequence, we prefer buying dips in 3, 7, or 11 swings. Conversely, in a bearish sequence, we focus on selling bounces within the same 3, 7, or 11 swing corrective structure. This way, we align our trades with the dominant market direction.

Moreover, we mark potential trade zones with the Blue Box on our charts, which guides members on where to enter trades and place stop losses, ensuring they follow the market’s overall path effectively.

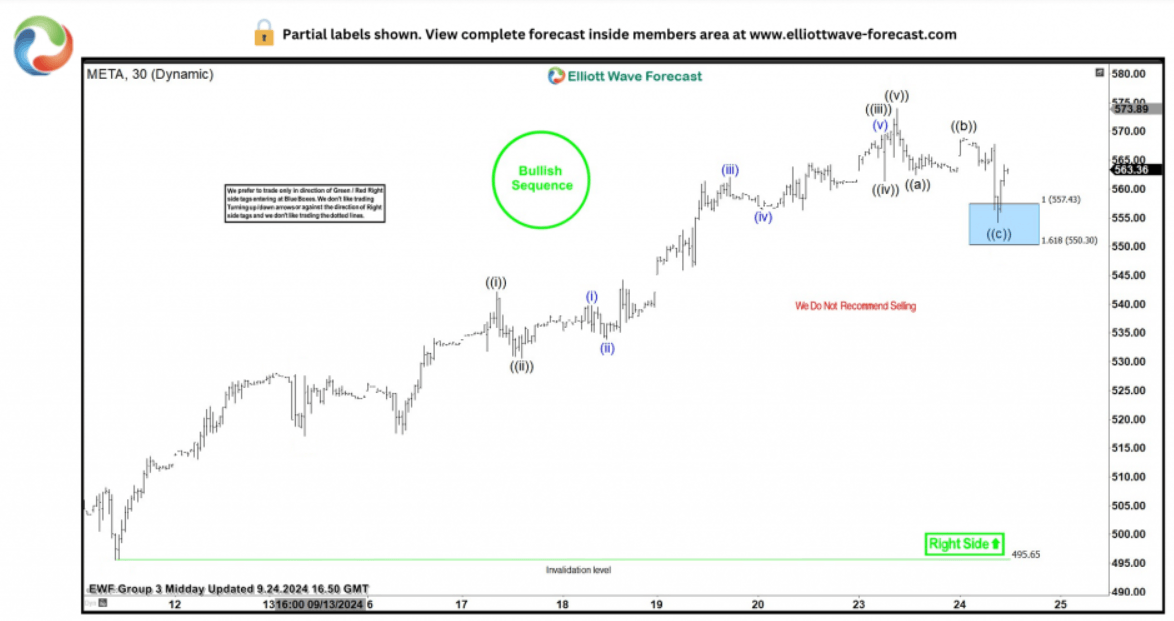

META Elliott Wave analysis 9.24.2024

On 9.24.2024, we shared the META H1 chart with members. We identified a 3-swing pullback which we expected to complete within the 557.43-550.30 blue box range. We recommended traders consider buying from this blue box, placing stops below it. Additionally, we provided a trade management guide in the trading journal and live trading room.

As the chart above shows, traders went long from the blue box. Shortly afterward, the price reacted and separated from the blue box to a risk-free area.

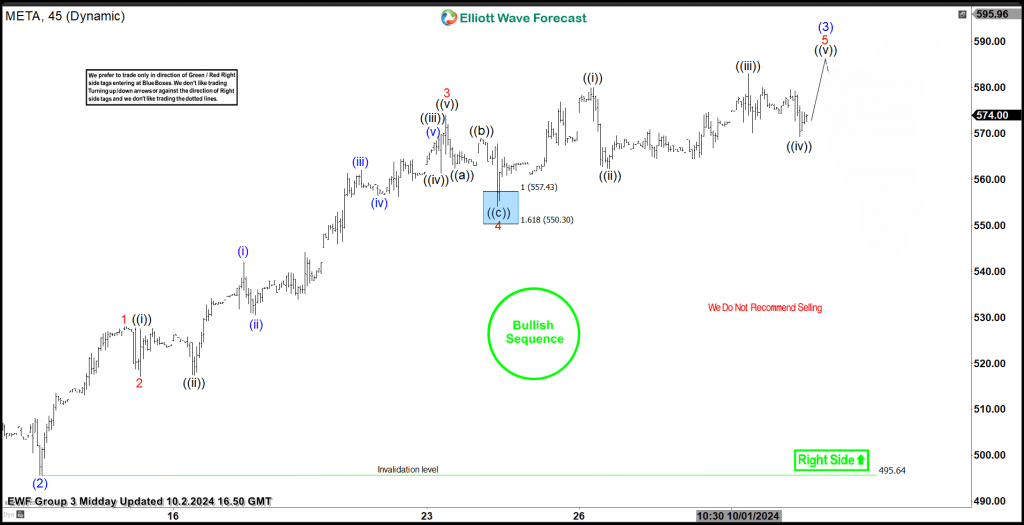

META Elliott Wave analysis 10.02.2024

On 10.02.2024, we shared the chart above with members, highlighting how far the price has moved away from the blue box. The chart also indicates that the impulse wave sequence is likely incomplete. From wave ((iv)), the price is expected to rally in wave ((v)) to complete wave (3). Afterward, a pullback for wave (4) should occur, and we can consider buying again if the pullback meets our entry criteria.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com