DWAC Stock Forecast: Digital World Acquisition extends declines despite market rally

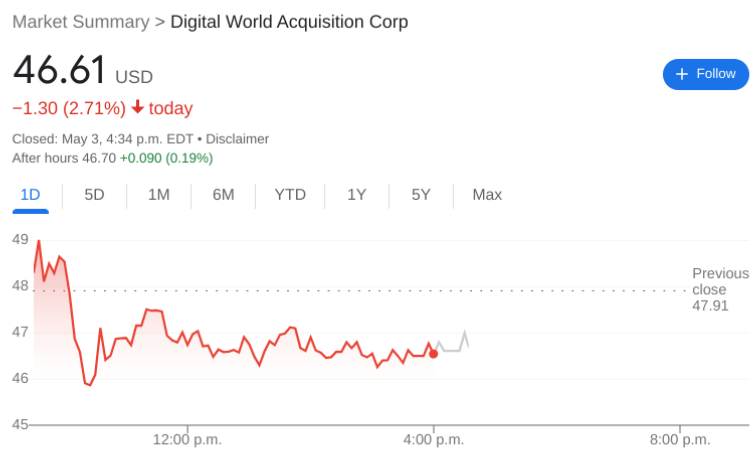

- NASDAQ: DWAC fell by 2.71% during Tuesday’s trading session.

- Elon Musk’s Twitter will have all of the free speech Truth Social claims to offer.

- Trump’s Supreme Court nominees vote to overturn the Roe vs Wade case for women’s rights.

NASDAQ: DWAC dropped lower for the second straight day to start May, even after opening the session in the green. On Tuesday, shares of DWAC fell a further 2.71% and closed the trading day at $46.61. The markets were choppy to say the least as all three major indices flip flopped between red and green throughout the day. Inventors were undecided ahead of a key FOMC rate hike that is widely expected for later this month. The Dow Jones gained 67 basis points, the S&P 500 added 0.48%, and the NASDAQ rose by 0.22% during the session.

Stay up to speed with hot stocks' news!

If Elon Musk is able to deliver on all of his promises for free speech on Twitter (NYSE: TWTR), then Truth Social’s main advantage might be lost. Musk has even gone as far as to lift the ban on former President Trump’s account, although so far Trump has declined his offer. It is unclear as to how Musk will be able to implement his vision of free speech on the platform, but it will likely include removing some of the various reasons as to why Twitter users can find themselves blocked.

DWAC stock price

In a controversial and leaked decision, it appears that the US Supreme Court will be striking down the precedent-setting Roe vs. Wade case. The decision allowed American women to have control over the decision to legally seek out an abortion. The leak has created a public outcry from a large number of Amercians including Hilary Clinton and President Biden himself. It has been pointed out by several news sources that Trump’s Supreme Court nominees have all voted in favor of striking down Roe vs. Wade.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet