Dow Jones soars 600 points as NFP data calms recession fears, weekly gains top 3%

- April Nonfarm Payrolls beat consensus at 177K; Unemployment Rate steady at 4.2%, easing recession concerns.

- Trump pressures Fed to cut rates despite upbeat data; CBOT shows 88 bps of easing priced in.

- Apple and Amazon fall on China sales miss and cloud growth slowdown despite beating EPS forecasts.

The Dow Jones Industrial Average (DJIA) rallied over 600 points, or over 1.65%, on Friday following a solid US jobs report that brushed aside fears that the largest economy in the world is tied into a recession. The Dow is set to end the week with gains of over 3% and, at the time of writing, hovers past the 41,300 mark after rebounding off the daily low of 40,658.

DJIA rallies past 41,300 as solid NFP data boosts sentiment, even as Fed rate cut expectations hold steady

US Nonfarm Payrolls in April increased by 177K, down from the downwardly revised number of 185K in March, but exceeding estimates of 130K. Earlier in the week, a dismal ADP National Employment Change report suggested that companies were hiring fewer people than the NFP revealed.

Also, the Unemployment Rate remained unchanged at 4.2%, aligned with forecasts, which might prevent the Federal Reserve (Fed) from easing policy.

Karen Georges, an equity fund manager at Ecofi in Paris, said, “These good numbers are not likely to fuel inflation, but this is no game changer for the Federal Reserve and Jerome Powell.”

US President Donald Trump took advantage of the good figures and slammed Fed Chair Jerome Powell in a post on his Truth Social network, demanding the Fed lower interest rates.

US Factory Orders in March rose by 4.3% MoM, up from 0.5% the previous month but slightly below the 4.5% foreseen.

Stocks related news

In the meantime, Apple (APPL) and Amazon (AMZN) shares are down 3.5% and 1%, respectively, with the former hit by a miss in sales in China and concern over tariffs. Apple revealed its earnings for Q1 2025, with earnings per share (EPS) coming at $1.65, above estimates of $1.62, and revenue of $95.36 billion, up from the $94.53 billion expected.

Amazon’s stock edged down as cloud revenue growth disappointed. In its earnings report for Q1 2025, EPS rose to $1.59, up from the $1.38 forecast, and revenue increased by $155.7 billion above forecasts of $154.88.

Fed expected to cut rates

Data from the Chicago Board of Trade (CBOT) shows the swaps market expects 88 basis points of easing toward the end of the year, as revealed by the December 2025 fed funds rate futures contract.

Dow Jones price forecast

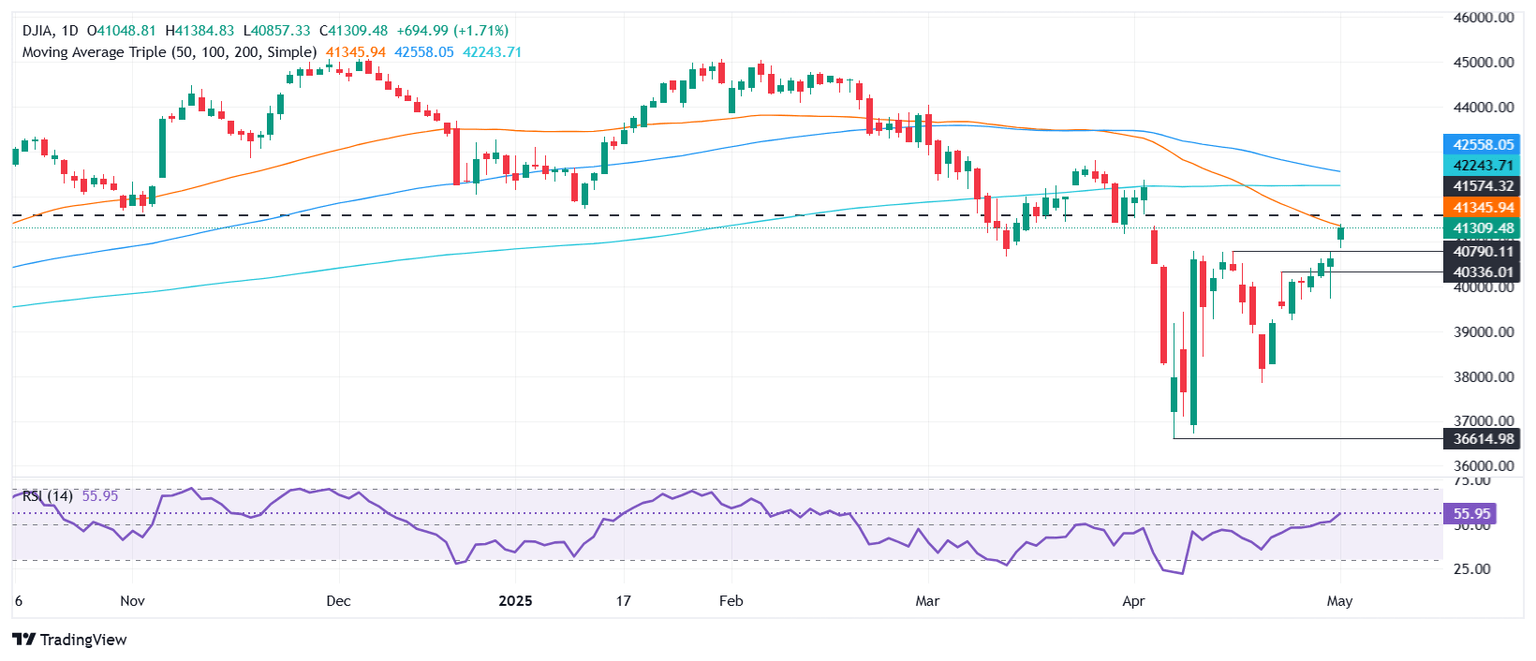

The Dow Jones remains downwardly biased, though traders are testing the 50-day Simple Moving Average (SMA) at 41,271. A daily close above the latter could extend the recovery past the 42,000 figure, with bulls targeting the 200-day SMA at 42,281.

Conversely, if the Dow tumbles below 41,000, the first support would be the 40,000 mark ahead of the 20-day SMA of 39,705. Once cleared the next support would be the April 23 low of 39,486, ahead of the April 22 high of 39,271 that would close the gap witnessed between April 22 and 23.

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.