Dow Jones Industrial Average extends rebound after cool PPI inflation print

- The Dow Jones added points on Thursday after better-than-expected June Retail Sales.

- Equities continue to claw back near-term losses as investors shake off economic and political doldrums.

- Consumer sentiment figures are in the barrel for Friday to round out a data-heavy week.

The Dow Jones Industrial Average (DJIA) extended a mid-week rebound on Thursday, tipping back into positive territory for the week as investors continue to brush off inflationary fears, tariff threats, and growing concerns that the Federal Reserve (Fed) could be poised to lose its political autonomy.

US Retail Sales data for June broadly came in above expectations, rising 0.6% MoM versus the previous month’s -0.9%. Rebounding Retail Sales bolstered investor confidence in conjunction with strong quarterly earnings released this week. Around 88% of earnings releases have exceeded Wall Street expectations.

Not-bad Retail Sales figures sparked a fresh lash out from President Donald Trump, aimed at Fed Chair Jerome Powell. Trump has ramped up his attacks on the Fed in recent weeks, culminating in Donald Trump signalling to Congress that he's prepared to remove Chair Powell from his position before Powell's term is over.

US labor data also came in better than expected, with weekly Initial Jobless Claims falling to 221K. Median market forecasts expected an uptick to 235K compared to the previous week’s 228K.

Rate cut hopes still hinge on inflation data

Consumer Price Index (CPI) inflation ticked higher earlier this week, sparking a fresh round of risk aversion and pushing investor hopes for Federal Reserve (Fed) rate cuts further down the calendar. Cooler-than-expected Producer Price Index (PPI) inflation assuaged investor fears of a resurgence in headline inflation pressures, and upbeat Retail Sales figures splashed further water on inflationary fires. However, rate markets are still reeling from a sharp readjustment in expectations. According to the CME’s FedWatch Tool, rate traders are still pricing in roughly even odds of a fresh rate trim in September, and around 40% odds of a follow-up cut before the end of the year.

Not all that glitters is gold

The devil is always in the details, and both PPI inflation data and Retail Sales numbers are no exception. The key stress point on inflation through 2025 is the Trump administration’s roughshod tariff strategy, and the PPI overwhelmingly excludes imported goods and materials from its calculations, meaning tariff-led inflation won’t show up in PPI results until its far too late to matter.

Headline Retail Sales are also calculated on an unadjusted basis, meaning monthly releases cannot differentiate between an actual uptick in consumer purchasing and increases in prices that consumers pay at the till. Real Retail Sales, which adjusts consumer purchasing volumes using the CPI, has remained essentially flat since reaching its latest peak in mid-2021.

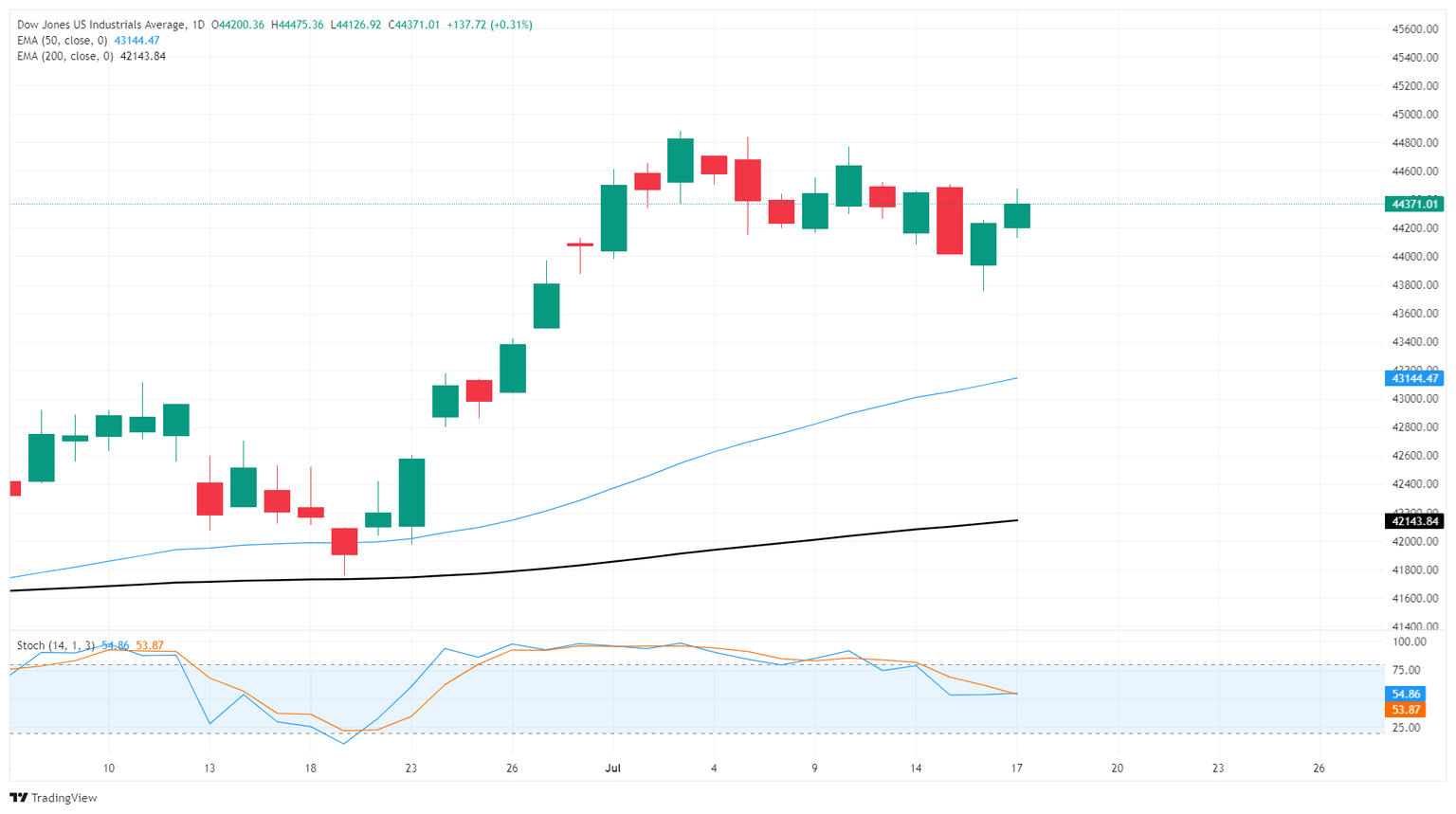

Dow Jones price forecast

The Dow Jones continues to find technical support from the 44,000 major price handle, but bullish momentum remains sluggish. The major equity index is holding in bullish territory for the week, but just barely. The Dow remains down over 1% from its latest swing high above 44,800, and equity bulls are struggling to muscle the Dow Jones back into record highs north of 45,000.

Dow Jones daily chart

Economic Indicator

Producer Price Index (YoY)

The Producer Price Index released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Changes in the PPI are widely followed as an indicator of commodity inflation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Wed Jul 16, 2025 12:30

Frequency: Monthly

Actual: 2.3%

Consensus: 2.5%

Previous: 2.6%

Source: US Bureau of Labor Statistics

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.