Dow Jones Industrial Average leans bullish post-NFP

- The Dow Jones tested 13-week highs on Friday after NFP jobs data beat the street.

- China approved rare earth exports to the US, bolstering trader hopes for a continued easing of tariffs.

- Key US inflation data coming up next week, tariff impacts due to begin leaking into headline data.

The Dow Jones Industrial Average (DJIA) briefly tested fresh 13-week peaks on Friday, with equities taking a step higher after Nonfarm Payrolls (NFP) jobs data came in stronger than expected. Trade tensions, or at least market perception of them, are also easing, keeping major indexes broadly bolstered to wrap up an otherwise middling trading week.

NFP net job gains were stronger than expected in May, showing an overall gain of 139K new payroll positions, beating the expected print of 130K. The figure is still down from April’s 147K, which was revised sharply lower after the Bureau of Labor Statistics (BLS) was forced to fix a data calculation error.

China caved to mounting pressure from the Trump administration on Friday, approving a batch of export licenses for rare earth dealers that supply critical minerals to the American automotive industry. President Trump and Chinese President Xi Jinping went tit-for-tat on accusations of violating early trade agreement terms last week.

Major indexes were further supported by a sharp recovery in Tesla (TSLA) shares, which took a hard hit this week as a very public fallout between President Trump and his former right-hand man, Elon Musk, boils over. Tesla shares plunged below $275 per share overnight before a sharp recovery back above $300 per share early on Friday. General tech stocks, including Nvidia (NVDA), Apple (AAPL), and Meta Platforms (META) all traded higher on Friday as general sentiment in the AI-fueled tech rally continues to lean into hopes that Trump’s anti-China stance on tech trade will be tempered over time.

Read more stock news: S&P 500 reaches 6,000 for first time since February on NFP print

Headline Consumer Price Index (CPI) inflation figures for May are due next week. Investors will be pivoting to face the first batch of inflation data that will include initial price volatility from the Trump administration’s whiplash tariff moves in April. Annualized headline CPI inflation is expected to rise to 2.5% YoY from 2.3%, and core CPI inflation measures are forecast to tick up to 2.9% from 2.8%.

Dow Jones price forecast

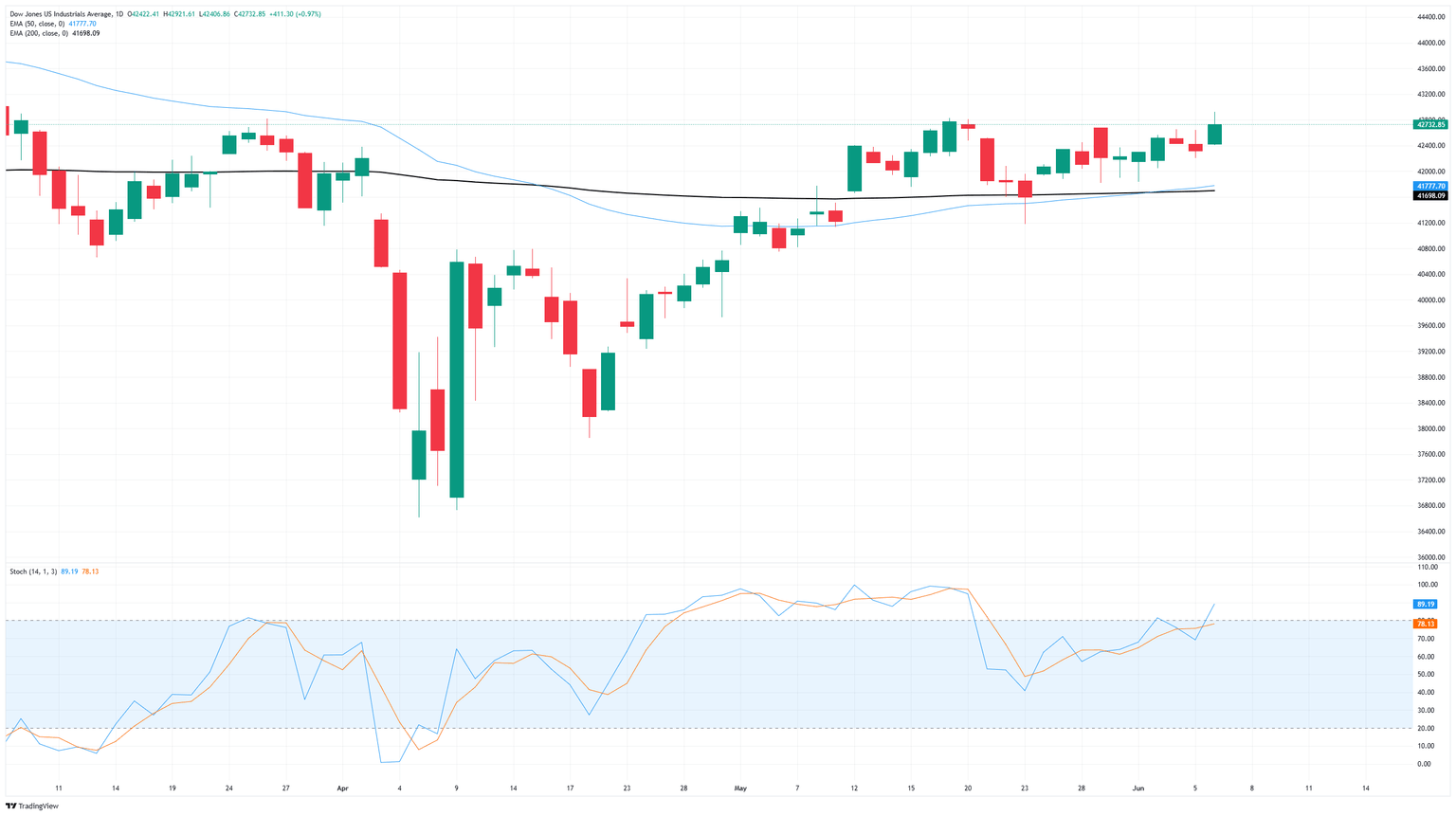

Despite testing a 13-week intraday high on Friday, Dow Jones bids remain trapped in near-term consolidation. The major equity index is adrift in a messy range between 42,800 and 41,200, with price action churning chart paper just above the 200-day Exponential Moving Average (EMA) near 41,640.

Dow Jones daily chart

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Jun 06, 2025 12:30

Frequency: Monthly

Actual: 139K

Consensus: 130K

Previous: 177K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.