Dow Jones Industrial Average follows equities higher

- The Dow Jones gained ground on Wednesday as equities broadly push higher.

- Markets are finding their bidding buttons amid a lack of game-changing news.

- US GDP growth, PCE inflation data due through the latter part of the week.

The Dow Jones Industrial Average (DJIA) drifted upwards on Wednesday as global equities grind their way higher heading through the midweek lull. Investors are shrugging off United States (US) President Donald Trump’s attempts to dump and replace voting members of the Federal Reserve (Fed), and markets are betting that this week’s upcoming Gross Domestic Product (GDP) and Personal Consumption Expenditures Price Index (PCE) inflation updates won’t break the bank on bets that the Fed will deliver a quarter-point interest rate cut in September.

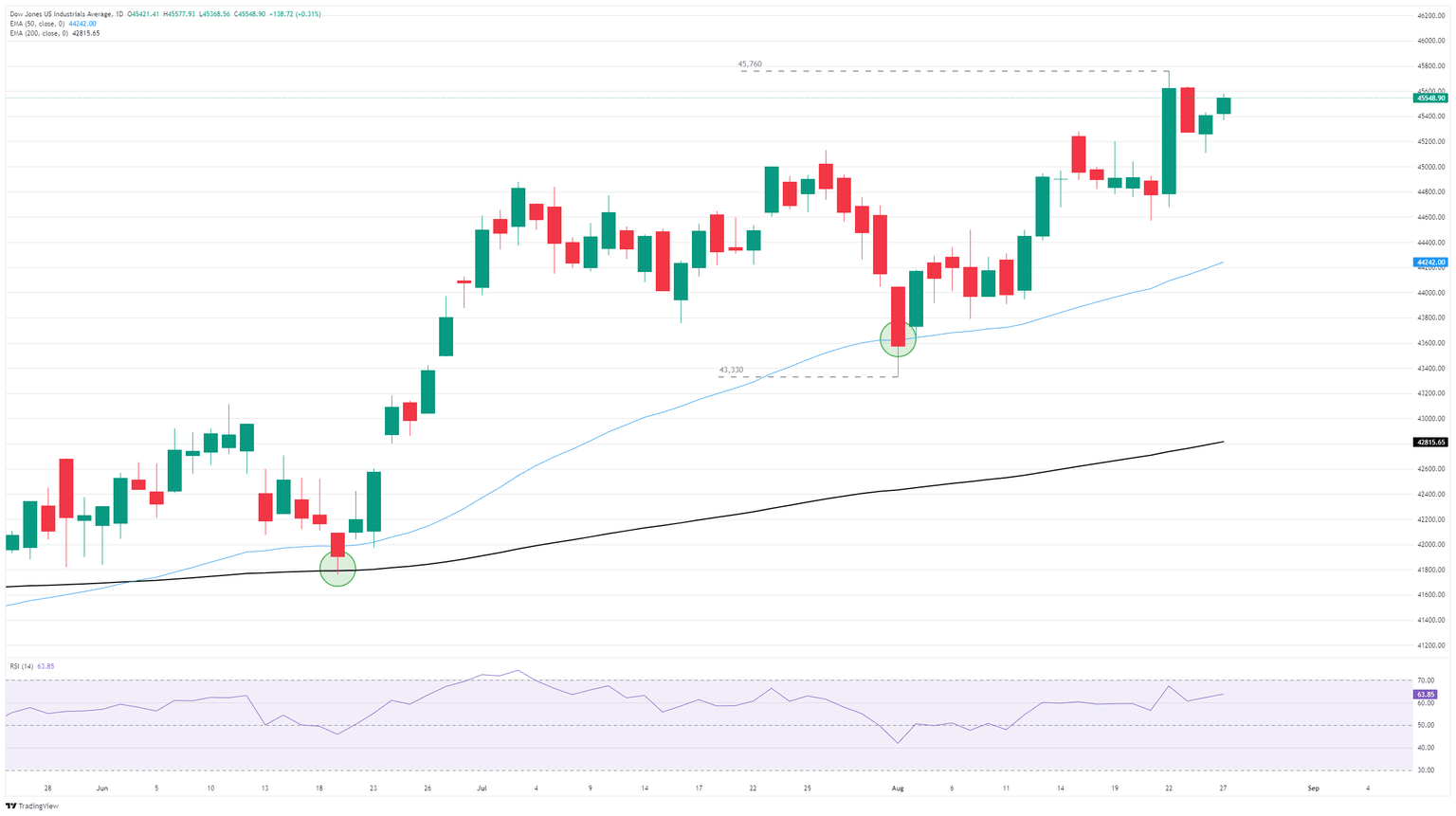

The Dow Jones is backfilling a technical decline that dragged the index off of record highs late last week, grinding back above the 45,500 level after finding a support floor near 45,200. The Dow is still a touch off its all-time peaks at 45,760, but the index’s long-term bullish tilt remains firmly intact.

US President Donald Trump is working on replacing Federal Reserve (Fed) Board of Governors members with his own picks who will, in theory, be more friendly to his desires for rapid interest rate cuts. Markets are largely brushing off the direct challenge to the Fed’s political autonomy, but a continued escalation in Fed policymaker headlines could chip away at investor sentiment moving forward.

PCE inflation, Nvidia earnings cast shadows over the midweek market

Q2 GDP growth figures are due on Thursday. Quarterly growth is expected to tick up to 3.1% on an annualized basis. The data docket is saving the best for last this week, with PCE inflation figures slated for Friday. Inflation remains a looming threat to the trajectory of Fed rate cuts, and could hammer back September rate cut hopes if it accelerates too fast, too quickly between now and September 17. July’s core PCE inflation is expected to rise to 2.9% YoY.

AI tech rally darling Nvidia (NVDA) will be releasing its latest quarterly earnings report after the closing bell on Wednesday. Nvidia has been the main driving force behind the AI-fueled bull run that has absorbed the lion’s share of equity moves recently. The chipmaker has grown so large that it now accounts for 8% of the entire Standard & Poor's 500 (SP500) index all by itself. Nvidia has outperformed analyst expectations for 11 of the last 12 straight earnings quarters, but still delivered a poor post-earnings performance for four of them.

Dow Jones daily chart

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Aug 29, 2025 12:30

Frequency: Monthly

Consensus: 2.9%

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.