Dow Jones Industrial Average trims early losses on less-than-feared Durable Goods Orders plummet

- The Dow Jones is clawing back recent losses as investor sentiment continues to climb.

- Traders continue to bank on an eventual walk back of the Trump team’s sky-high tariff threats.

- Trade deals remain limited, and the August 1 deadline is approaching fast.

The Dow Jones Industrial Average (DJIA) rebounded on Friday, recovering its footing after a mild downturn during the previous session. Q2 earnings broadly beat the street this week, sending most major indexes into record highs, but the Dow Jones grappled with some downside in key overweight stocks, crimping the blue-chip average’s top line.

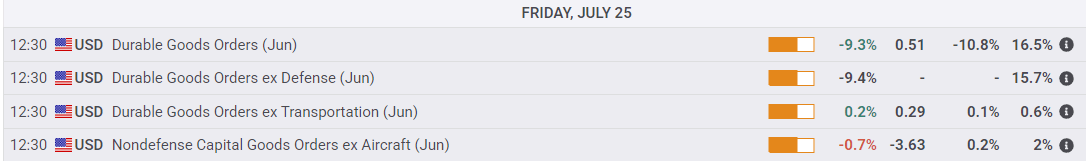

Markets rise on milder-than-expected durables decline

Headline Durable Goods Orders contracted sharply in June, contracting by 9.3% and marking in the worst two-month change since the covid pandemic. However, the top-line figure still beat median forecasts of a 10.8% contraction, bolstering immediate market reactions.

Durable Goods Orders excluding vehicles rose 0.2% MoM versus the expected 0.1%, highlighting how much of the headline decline was a result of a hard wobble in the US’s automotive sector as global-facing tariffs and steep steel and aluminum import taxes are beginning to hit US consumers and businesses alike.

US-EU trade deal: The eternal 'maybe'

Rumors continue to swirl around the tank about a possible trade deal between the US and the European Union (EU), but a continuous cycle of teases and hints from staffers under US President Donald Trump has become rote for investors awaiting firm details. The Trump administration has scrambled to secure trade deals ahead of its own self-imposed deadline of August 1. Despite multiple announcements of agreements between the US and several other countries, including the United Kingdom (UK) and Japan, very little actual paperwork has been created, leaving most market participants in the dark about what the US’s physical trade environment will look like in the near future.

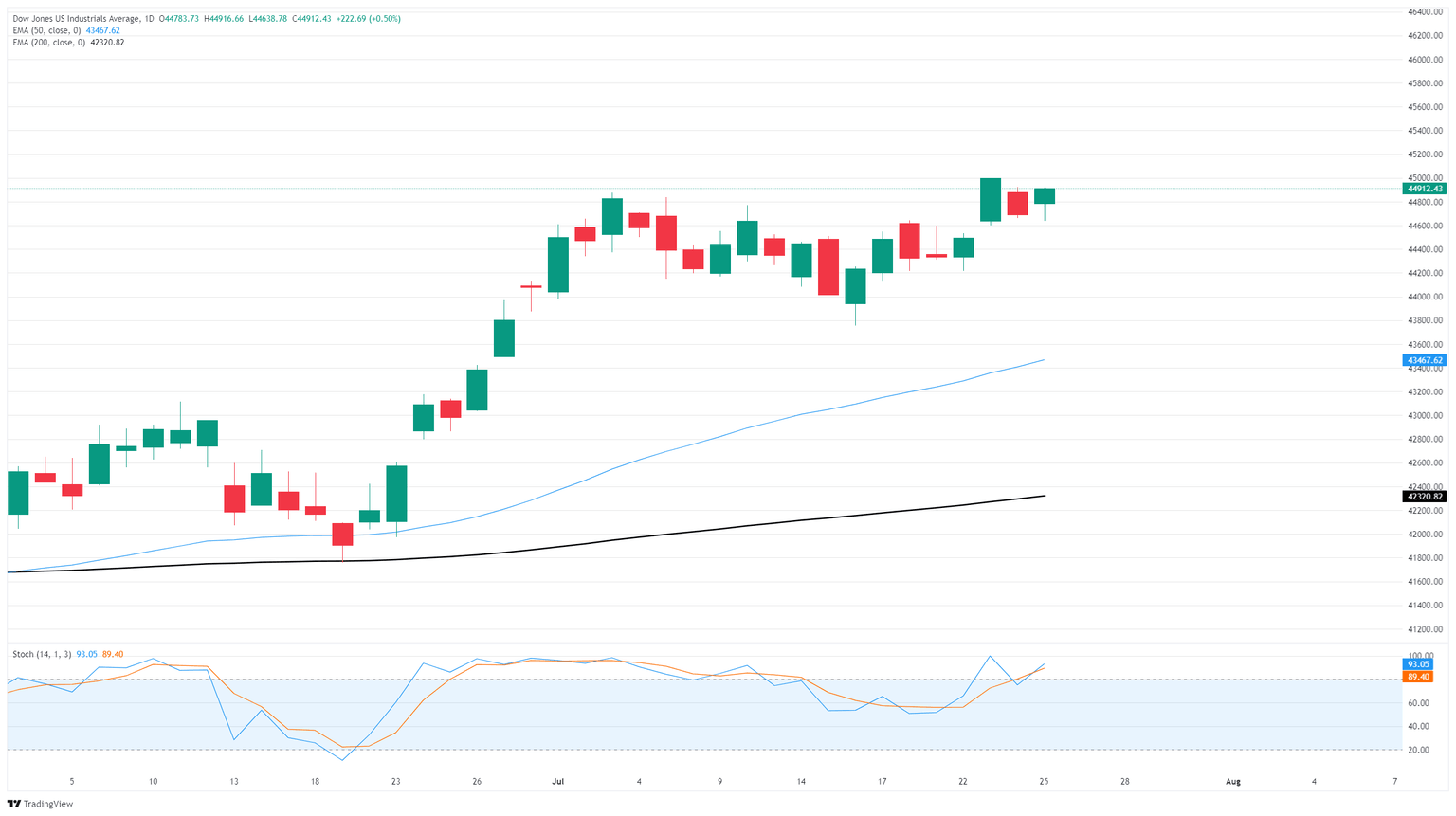

Dow Jones price forecast

The Dow Jones’ recovery on Friday has pushed the index back into the bullish side of recent congestion, and the DJIA is holding steady near all-time highs as bullish price action battles for a foothold near 45,000. Despite a firm upswing this week, the Dow is struggling to reclaim record high territory as its major index peers outperform the comparatively tech-light Dow Jones.

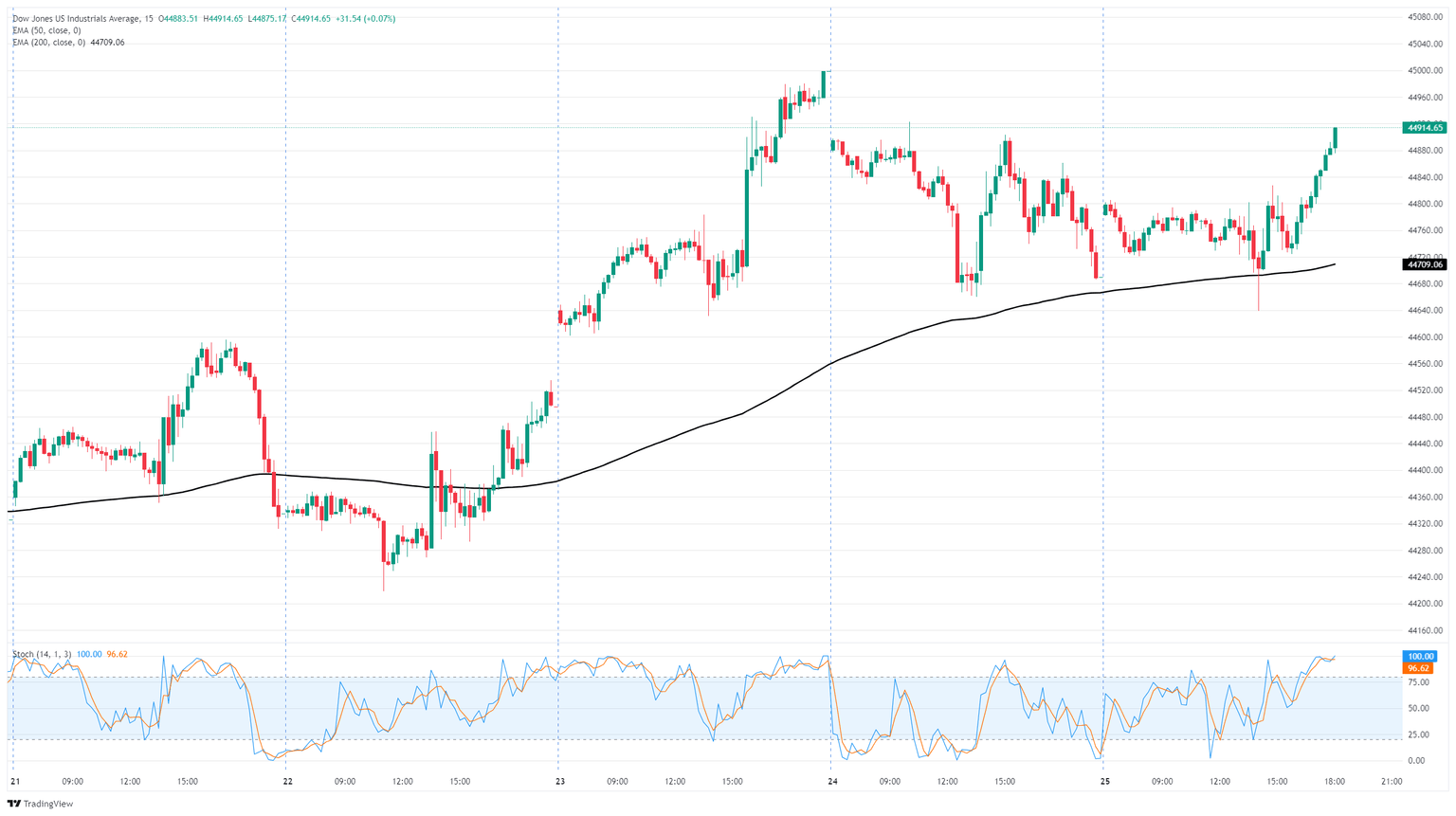

Dow Jones 15-minute chart

Dow Jones daily chart

Economic Indicator

Durable Goods Orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

Read more.Last release: Fri Jul 25, 2025 12:30

Frequency: Monthly

Actual: -9.3%

Consensus: -10.8%

Previous: 16.4%

Source: US Census Bureau

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.