Dow Jones Industrial Average rebounds as investors shake off tariff fears

- The Dow Jones rebounded on Thursday, clawing back early-week losses.

- The Trump administration has warned of even more tariffs, targeting specific countries and goods.

- Investors are stepping back into markets as they bet on further tariff walkbacks.

The Dow Jones Industrial Average (DJIA) rose on Thursday, paring back early-week losses following a fresh round of tariff threats from President Donald Trump. Investors balked at announcements of double-digit tariff increases on all imported goods from specific countries, including South Korea and Japan, as well as 50% tariffs on all copper imports and goods from Brazil.

With reciprocal tariffs delayed until August 1, investors are banking on the Trump administration finding a reason to further delay or suspend both the reciprocal tariffs package initially announced in April, as well as a fresh batch of tariffs aimed at specific countries and sectors announced throughout the first half of the week. Market participants remain confident that the brunt of Trump’s tariff threats won’t come to pass, and trader confidence is inching higher as inflationary pressures from the tariffs that Trump has managed to enact remains tepid at best.

Jobless Claims hold steady for another week

US Initial Jobless Claims came in better than expected on Thursday, showing fewer than expected new jobless benefits applicants through the week. 227K net benefits seekers versus the previous 233K wasn’t a major shift in unemployment claims, but stable data figures are enough to keep investor sentiment on the rails.

Federal Reserve (Fed) officials who believe it may be time to deliver rate cuts are beginning to come out of the woodwork. Based on the Fed’s latest Meeting Minutes delivered this week, the spread between cut-to-no-cut bets by policymakers has widened in recent months, and particularly dovish Fed personnel are taking the opportunity to shoot their shot in the public arena. President Donald Trump has been clamoring for rate cuts from the Fed, accelerating his smear campaign against Fed Chair Jerome Powell. Fed Chair Powell continues to hold firm to the Fed’s wait-and-see stance on interest rates, as constantly changing trade policies continue to weigh on both markets and businesses across the US.

Dow Jones price forecast

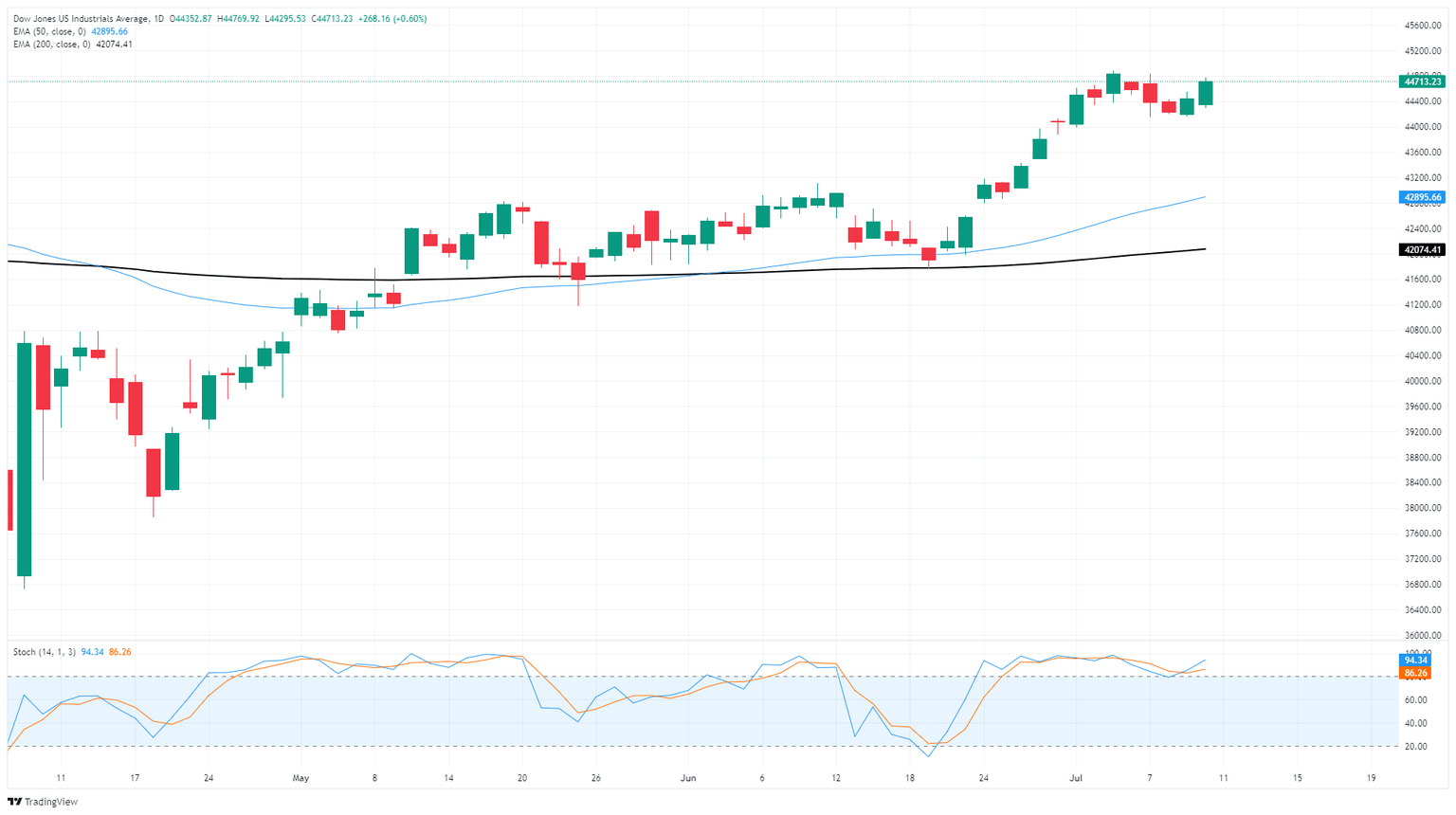

The Dow Jones chalked in a gain on Thursday, clawing back the early week’s losses and putting the major equity index back on the high side heading into the tail end of the trading week. The Dow is still holding steady near the 44,700 level, with bullish momentum poised to take another fresh crack at all-time highs just north of 45,000.

Dow Jones daily chart

(This story was corrected on July 10 at 20:36 GMT to name the correct ticker for the Dow Jones Industrial Average as DJIA, not SJIA.)

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Last release: Thu Jul 10, 2025 12:30

Frequency: Weekly

Actual: 227K

Consensus: 235K

Previous: 233K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.