Dow Jones Industrial Average gains ground after not-too-hot CPI print

- The Dow Jones rebounded on Tuesday after CPI inflation data came in better than investors feared.

- Despite the upbeat market reaction, inflation data continues to flash some early warning signs.

- PPI inflation, Retail Sales, and consumer sentiment survey results due later this week.

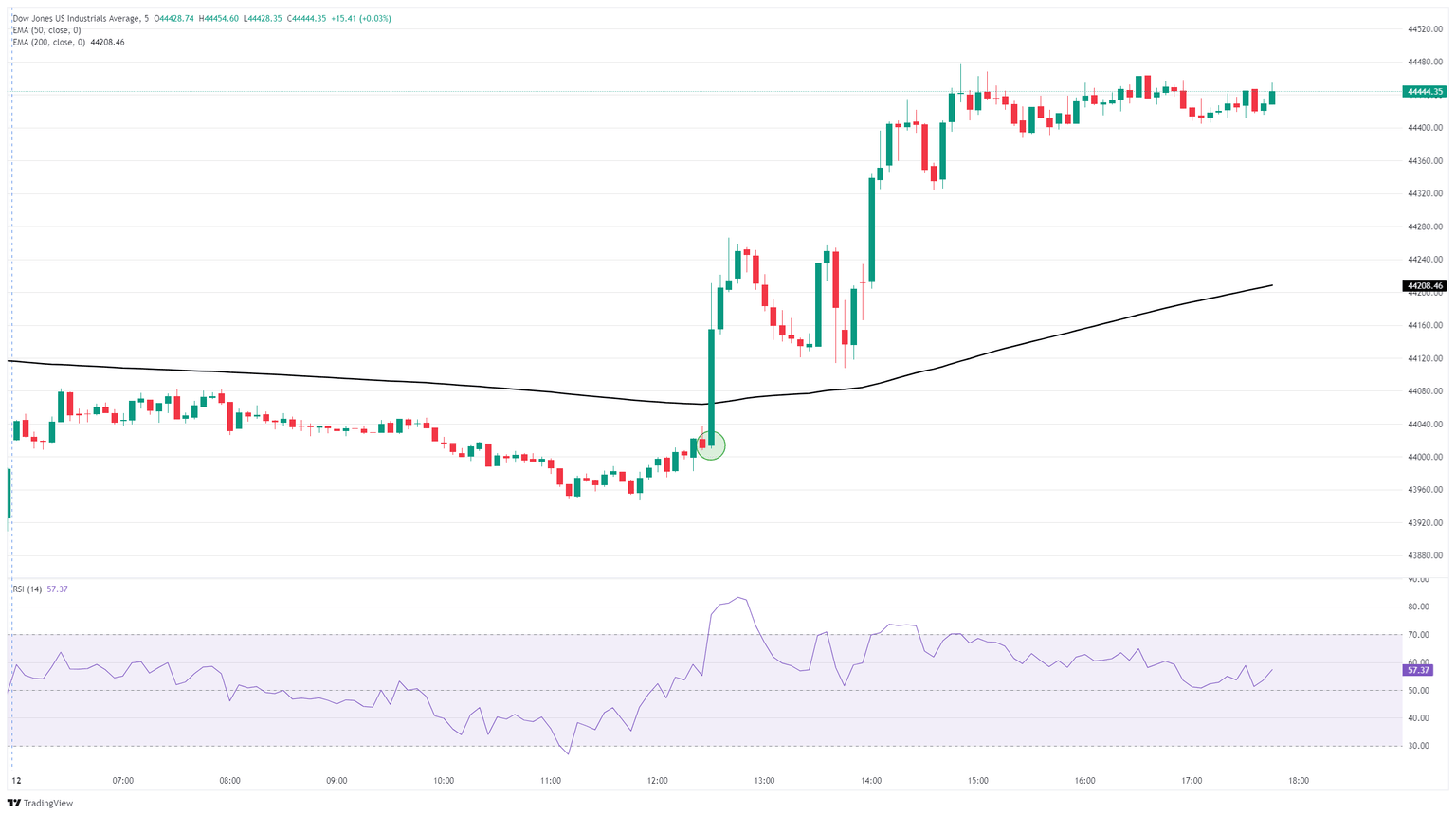

The Dow Jones Industrial Average (DJIA) caught some bullish lift on Tuesday, rising around 450 points after United States (US) Consumer Price Index (CPI) inflation data from July failed to push markets off of bets for an interest rate cut from the Federal Reserve (Fed) in September.

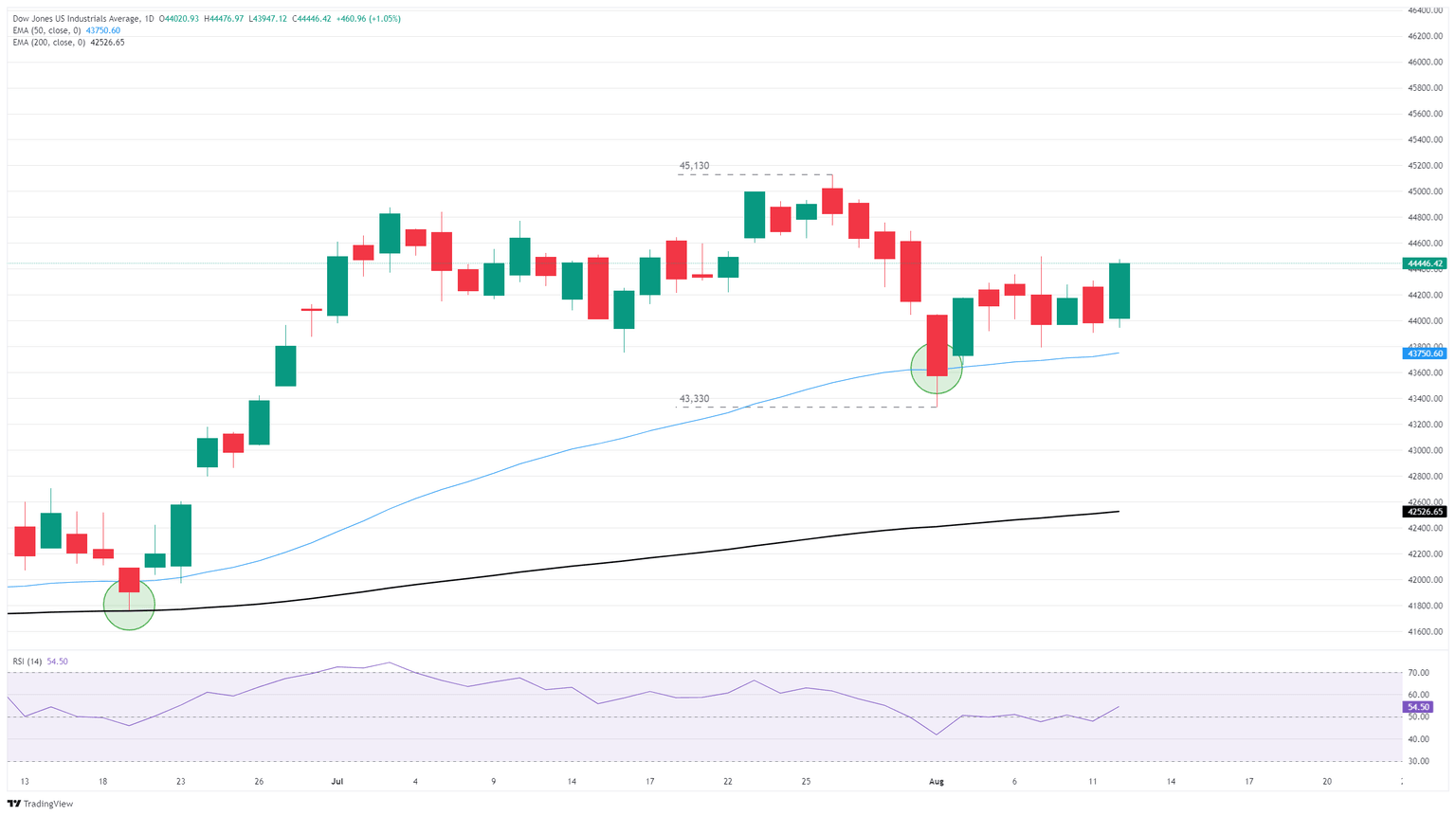

The Dow bounced back above 44,400 to punch in a new high for the week and pushed into the high end of near-term consolidation. The Dow Jones is still catching some lift following a bullish bounce from the 50-day Exponential Moving Average (EMA), which is now rising into 43,800, and the trick for bidders will be to muscle the major index back above 44,500. Should bullish momentum falter here, the Dow could backslide into a firm consolidation phase.

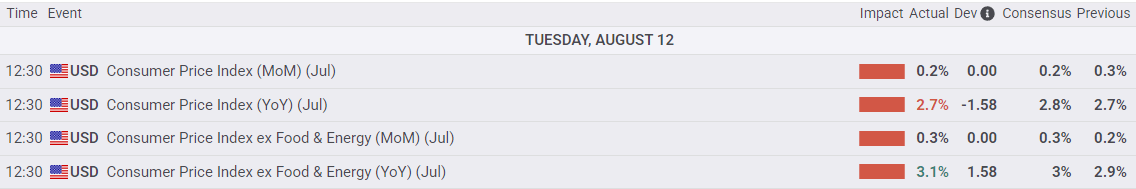

Headline CPI inflation came in better than expected, holding steady at 2.7% YoY in July versus the expected uptick to 2.8%. Despite investors maintaining their positive mood following the CPI release, the figure indicates that there has been no functional progress in taming headline CPI inflation since September 2024. Core CPI metrics further pointed to potential issues, with inflation minus volatile food and energy prices accelerating to 3.1% YoY, wiping out six months of minimal progress on core inflation.

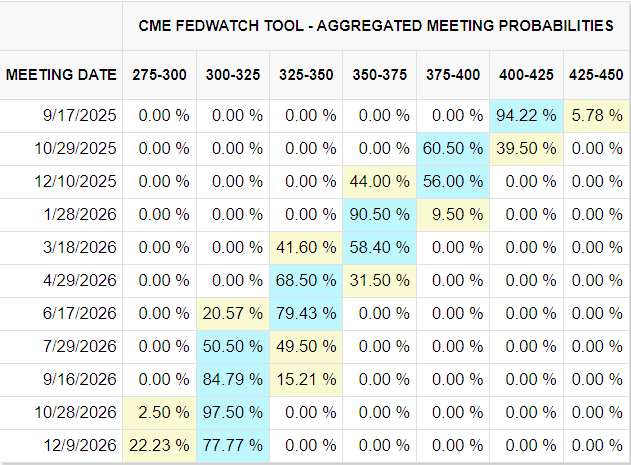

Despite still-stubborn inflation data, investors are still leaning firmly into bets of a Fed rate cut on September 17. According to the CME FedWatch Tool, rate betters see nearly 95% odds of at least a quarter-point rate trim at the Fed’s next interest rate decision. Odds of a follow-up rate cut in October also climbed above 60%, and rate traders have priced in 90% odds that the Fed will reach three-quarters of a point in rate cuts by the end of next January.

Trump team tries to steal the limelight back from inflation

Not to be outdone by market headlines, US President Donald Trump announced that not only is Fed Chair Jerome Powell “too slow” to deliver interest rates, he is considering allowing a legal case to proceed against the head of the Fed, whom he himself nominated for the position during his first term. According to Trump, the costs of the Fed building restoration, which is paid by neither the taxpayers nor the government, has become “too expensive”, which Trump ostensibly intends to use as justification for suing Fed Chair Powell for refusing to lower interest rates. Apparently, the Trump administration remains unaware that the Federal Open Market Committee (FOMC) sets rates via a majority vote at regularly scheduled meetings throughout the calendar year.

Seeding clouds to make a rainy day later, Trump’s pick to head the Bureau of Labor Statistics (BLS) suggested in an interview with Fox News that the BLS should pause publishing monthly labor data. EJ Antoni, the chief economist of the conservative political campaign group Heritage Foundation, was tapped by Donald Trump to replace the head of the BLS, whom Trump had terminated in a whiplash reaction to the latest sour patch of US labor data.

Dow Jones 5-minute chart

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Tue Aug 12, 2025 12:30

Frequency: Monthly

Actual: 3.1%

Consensus: 3%

Previous: 2.9%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.